There are many choices available to you if accounting associate's degrees are something you want. Earning an accounting associate's degree offers many benefits, and the job marketplace is improving. Before you decide on an accounting program, there are some things you need to consider. Find out what you can expect from the different programs. This article will discuss cost, job opportunities, and transferability. Here are the top 5 reasons to study accounting.

Online programs

If you want to be an accountant but don't have a lot of time to attend classes, an online accounting associate's degree program may be a perfect choice. The degree teaches students the basic accounting concepts and focuses on problem-solving, critical thinking, and business acumen. This degree also teaches soft skill like communication and teamwork. You can also get your Bachelor of Science Degree in Accounting online.

Northern Virginia Community College's Associate of Applied Science, Accounting program is another popular online course. This program is unlike traditional schooling. It's designed specifically for working adults. Spreadsheet Software; Principles of Federal Taxation; Financial Management; Intermediate Accounting I & II. Students can also add on the Accounting Career Studies Certificate to complete their degree. Students can also be prepared for entry-level positions as trainees, assistants, or technicians in the accounting industry.

Cost

Although tuition fees for accounting associates vary from one place to the next, the average cost is well over $10,000. Many times grants and scholarships can cover the majority of the tuition for an accounting associate's degree. The average cost is between $6,100 to $10,000. Scholarships vary widely, but the San Diego Chapter of the American Society of Women Accountants offers two $500 scholarships each year for students interested in pursuing an accounting degree. Similar scholarships are offered by other chapters.

Davenport University has an associate in business administration degree in accounting. It is accredited by International Accreditation Council for Business Education. The course helps students set up and maintain an effective accounting system, prepare financial statements, handle business transactions, as well as how to manage them. High-qualified faculty have extensive experience in this field. Students also get hands-on experience through service learning or networking events. The University has over 150 year of experience in preparing graduates for successful careers.

There are many job opportunities

A two-year accounting degree provides excellent job opportunities in many fields. Bookkeeping involves the preparation of financial reports and ledgers as well as maintaining extensive records. The two-year program is highly beneficial for entry-level candidates who have just completed the coursework. Accounting degrees that are two years long have excellent job prospects and growth potential. Accounting jobs can be highly lucrative and highly in-demand. They also have a wide range of responsibilities.

You can become an entry-level accountant after completing a 2-year program. Many people prefer to work as bookkeepers and clerks under the guidance of a certified public accountant. There are also positions that could be available as business trainees, accountants, or clerks. Small businesses frequently require entry-level accountants to process tax returns or prepare financial records. A Bachelor's degree in Accounting will allow you to get your foot in many different fields.

Transferability

Accreditation status plays a major role in determining whether an accounting associate's diploma is transferable. Accreditation refers a comprehensive review of a school’s educational standards. Accreditation is done based on both local and national guidelines in the United States. Accreditation council for business schools and programs (ACBSP), a highly specialized accrediting institution, has accredited accounting associate's degree programmes.

Generally, an accounting associate's degree program has a core curriculum made up primarily of required courses. But, the program offers additional electives. In most cases, the course sequence is closely matched with a bachelor's degree, so transferability is generally good. Accounting associate's degrees can be used to get entry-level jobs, but some credits cannot be transferred to bachelor's degree programs.

FAQ

What happens if the bank statement I have not reconciled is not received?

You might not realize that you made a mistake in reconciling your bank statements until the end.

You will have to repeat the whole process.

Why is reconciliation important

This is important as you never know when errors might occur. Mistakes include incorrect entries, missing entries, duplicate entries, etc.

These problems can have serious consequences such as inaccurate financial statements, missed deadlines and overspending.

What does it really mean to reconcile your accounts?

Reconciliation involves comparing two sets of numbers. One set is called the "source," and the other is called the "reconciled."

Source consists of actual figures. The reconciled is the figure that should have been used.

If someone owes $100 but you receive only $50, this would be reconciled by subtracting $50 from $100.

This ensures there are no errors in the accounting system.

How can I get started keeping books?

A few items are necessary to start keeping books. You will need a notebook, pencils and calculators, a printer, stapler, pen, stapler, envelopes and stamps, as well as a filing cabinet or drawer.

What are the differences between different bookkeeping systems?

There are three main types of bookkeeping systems: manual, computerized and hybrid.

Manual bookkeeping refers to the use of pen & paper to record records. This method requires attention to every detail.

Software programs are used for computerized bookkeeping to manage finances. It saves time and effort.

Hybrid bookkeeping is a combination of both computerized and manual methods.

What exactly is bookkeeping?

Bookkeeping refers to the process of keeping financial records for individuals, companies, or organizations. It includes recording all business-related expenses and income.

All financial information is kept track by bookkeepers. These include receipts. Invoices. Bills. Payments. Deposits. Interest earned on investments. They prepare tax returns, as well as other reports.

What is an Audit?

An audit is a review of a company's financial statements. Auditors examine the company's books to verify everything is correct.

Auditors examine for discrepancies in the reporting and actual events.

They also verify that the financial statements of the company are correct.

Statistics

- Given that over 40% of people in this career field have earned a bachelor's degree, we're listing a bachelor's degree in accounting as step one so you can be competitive in the job market. (yourfreecareertest.com)

- "Durham Technical Community College reported that the most difficult part of their job was not maintaining financial records, which accounted for 50 percent of their time. (kpmgspark.com)

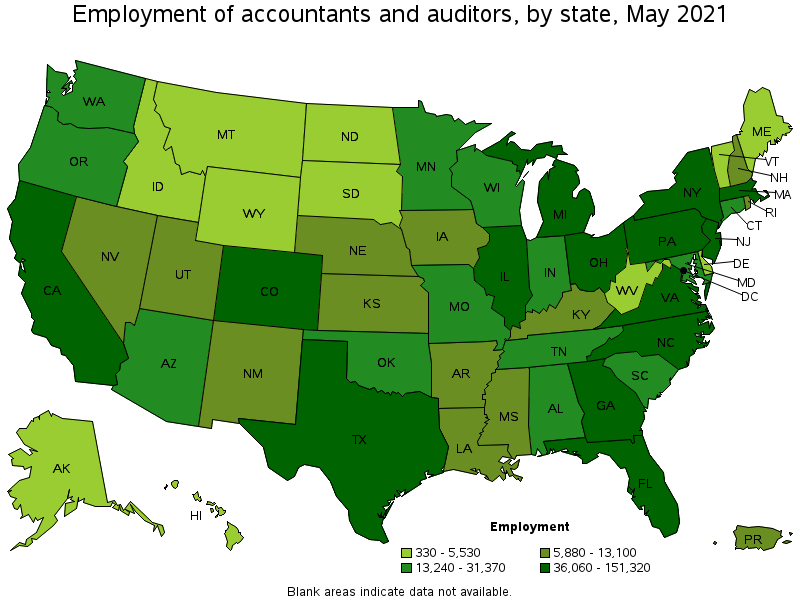

- Employment of accountants and auditors is projected to grow four percent through 2029, according to the BLS—a rate of growth that is about average for all occupations nationwide.1 (rasmussen.edu)

- BooksTime makes sure your numbers are 100% accurate (bookstime.com)

- According to the BLS, accounting and auditing professionals reported a 2020 median annual salary of $73,560, which is nearly double that of the national average earnings for all workers.1 (rasmussen.edu)

External Links

How To

How to Become An Accountant

Accounting is the science and art of recording financial transactions and analyzing them. It can also involve the preparation statements and reports for various purposes.

A Certified Public Accountant or CPA is someone who has passed an exam and received a license from the state board.

An Accredited financial analyst (AFA), or an individual who meets the requirements of the American Association of Individual Investors, is an individual who is accredited by Financial Analysts. A minimum of five year's investment experience is required before an individual can be made an AFA. They must pass several examinations to prove their understanding of securities analysis.

A Chartered Professional Accountant (CPA), sometimes referred to as a chartered accountant, is a professional accountant who has been awarded a degree from a recognized university. The Institute of Chartered Accountants of England & Wales (ICAEW) has established specific educational standards for CPAs.

A Certified Management Accountant (CMA) is a certified professional accountant specializing in management accounting. CMAs must pass the ICAEW exams and continue their education throughout their careers.

A Certified General Accountant is a member of American Institute of Certified Public Accountants. CGAs must pass multiple exams. One of these tests, the Uniform Certification Examination or (UCE), is required.

International Society of Cost Estimators' (ISCES) offers the Certified Information Systems Auditor certification. Candidates for the CIA certification must complete three levels, which include coursework, practical training and a final assessment.

Accredited Corporate Compliance Official (ACCO), a title granted by ACCO Foundation and International Organization of Securities Commissions. ACOs must hold a baccalaureate or higher degree in business administration, finance, or public policy. Additionally, they must pass two written and one verbal exams.

A credential issued by the National Association of State Boards of Accountancy is called a Certified Fraud Examiner. Candidates must pass three exams, and get a minimum score 70%.

International Federation of Accountants is accredited a Certified Internal Audior (CIA). The International Federation of Accountants (IFAC) requires that candidates pass four exams. These include topics such as auditing and risk assessment, fraud prevention or ethics, as well as compliance.

An Associate in Forensic Accounting (AFE) is a designation given by the American Academy of Forensic Sciences (AAFS). AFEs must have graduated from an accredited college or university with a bachelor's degree in any field of study other than accounting.

What does an auditor do? Auditors are professionals who conduct audits of organizations' internal controls over financial reporting. Audits can take place on an individual basis or on the basis of complaints received from regulators.