To become a certified public accountant in Idaho, you will need to meet certain educational requirements. There are many factors to consider, including the bachelor's degree requirement, the 30 additional semester hours, and age and residency requirements. Read on to learn more. Here are the minimum education requirements in Idaho to become CPA. Idaho's State Department of Education is responsible for education in the state. There are additional educational requirements that are not included in this article.

Bachelor's degree

To sit for the CPA examination in Idaho, you must have a bachelor's degree in accounting. The minimum age to apply is 18 years. Candidates must either have been residents of Idaho for the last two years or intend to become residents upon successful completion. For the exam to be taken, candidates must hold a baccalaureate. The degree must include at least 30 credit hours or 45 quarter hours of coursework in accounting.

After graduation, applicants must complete 2,000 hours professional experience in accounting services. This can be part-time or full time, and must be completed within the last 36 month. A mandatory ethics course must be completed by them. It must have a minimum score not less than 90%. Candidates interested in obtaining their Idaho CPA License should take the course offered by the AICPA.

Additional semester hours: 30

Candidates must have completed a minimum of 150 semester hours college-level coursework in order be eligible to take the Uniform CPA exam in Idaho. The education must include at minimum 30 hours of accounting and other business-related coursework. Candidate must also hold a bachelor's or equivalent degree. The degree program also must contain at least 20 hours of accounting coursework. For aspiring CPAs, the University of Idaho offers an Online Program.

Idaho licenses must be renewed every 2 years. A new licensee must also meet all renewal requirements by July. The cost of renewing a license in Idaho is $120. CPAs must complete 80 hours of continuing professional education (CPE) every two years, including four hours of ethics. CPA licenses must be renewed every 2 years. There is also a 4-year reporting period for CPE. CPAs licensed in Idaho are required to complete 30 additional hours of CPE each year.

Age requirement

Idaho has an 18-year-old age requirement for CPA licensure. This means that either you are a current or past resident in Idaho. If you are a highschool senior, this means you must have completed high school graduation requirements. All applicants must have had at least 2,000 hours of experience in the workplace. A complete list of acceptable work experience is maintained by the state's CPA boards.

Not only must the applicant meet the state's minimum age, but they also need to have completed a graduate degree in accounting or other related fields. This course should be accredited by a regional accrediting agency and be based in Idaho. The program must have at least 24 hours of accounting coursework. These include financial, taxation, management, auditing, and taxation. It must also include business courses that cover human resource management, accounting principles and a legal basis.

Residency requirements

Idaho has a residency requirement to obtain a CPA licensure. This state requires that you've lived in Idaho for at most two years. You will need to apply again for your license if you have moved from Idaho. At least 18 years of age. The Idaho State Board of Accountancy must recognize your degree and confirm that you have completed accounting education.

The exam for the Idaho CPA license is open book, and you will have three attempts to pass it. The exam must be taken at an approved testing facility. Once you have passed the examination, you must obtain the required work experience to renew your license. A minimum of 2,000 hours professional experience must be obtained in an accounting/financial services organization. Work experience can be part-time or full-time. However, it must be under the guidance of a licensed CPA.

FAQ

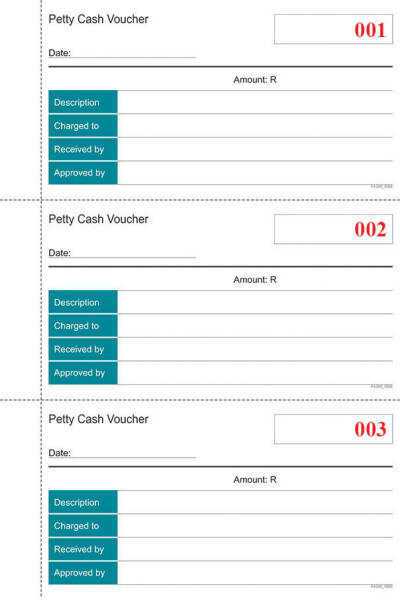

What are the different types of bookkeeping systems?

There are three types of bookkeeping systems available: computerized, manual and hybrid.

Manual bookkeeping uses pen and paper to keep track of records. This method requires constant attention.

Software programs are used to automate bookkeeping and manage finances. It saves time and effort.

Hybrid bookkeeping is a combination of both computerized and manual methods.

What's the difference between a CPA or Chartered Accountant?

Chartered accountants are professional accountants who have passed the required exams to earn the designation. Chartered accountants usually have more experience than CPAs.

Chartered accountants are also qualified to offer tax advice.

A chartered accountancy course takes 6-7 years to complete.

What training is needed to become an accountant?

Basic math skills are necessary for bookkeepers. They need to be able to add, subtract, multiply, divide, fractions and percentages.

They also need to know how to use a computer.

The majority of bookkeepers have a high-school diploma. Some even have college degrees.

How long does it take for an accountant to become one?

Passing the CPA test is essential in order to become an accounting professional. Most people who want to become accountants study for about 4 years before they sit for the exam.

After passing the exam, one must be an associate for at most 3 years in order to become a certified public accounting (CPA) after passing it.

What is the purpose and function of accounting?

Accounting provides a view of financial performance by measuring and recording transactions, analyzing them, and reporting on them. It enables organizations to make informed decisions regarding how much money they have available for investment, how much income they are likely to earn from operations, and whether they need to raise additional capital.

Accounting professionals record transactions to provide financial information.

The company can then plan its future business strategy, and budget using the data it collects.

It is crucial that the data are accurate and reliable.

Accounting is useful for small business owners.

Accounting is not only for large businesses. Accounting is also beneficial for small business owners, as it allows them to keep track of all their money.

If you run a small business, you likely know how much money comes in each month. What happens if an accountant isn't available to you? You may be wondering where your money is being spent. You could also forget to pay bills on-time, which could impact your credit score.

Accounting software makes keeping track of your finances easy. There are many options. Some are absolutely free while others may cost hundreds or even thousands of dollars.

However, regardless of the type of accounting software you choose, you will need to be familiar with its basics. You won't have to spend time learning how it works.

You should learn how to do these three basics tasks:

-

Record transactions in the accounting system.

-

Track your income and expenses.

-

Prepare reports.

Once you have these three skills, you are ready to begin using your new accounting program.

Statistics

- "Durham Technical Community College reported that the most difficult part of their job was not maintaining financial records, which accounted for 50 percent of their time. (kpmgspark.com)

- BooksTime makes sure your numbers are 100% accurate (bookstime.com)

- a little over 40% of accountants have earned a bachelor's degree. (yourfreecareertest.com)

- The U.S. Bureau of Labor Statistics (BLS) projects an additional 96,000 positions for accountants and auditors between 2020 and 2030, representing job growth of 7%. (onlinemasters.ohio.edu)

- According to the BLS, accounting and auditing professionals reported a 2020 median annual salary of $73,560, which is nearly double that of the national average earnings for all workers.1 (rasmussen.edu)

External Links

How To

How to do Bookkeeping

There are many types of accounting software available today. While some software is free and some cost money to purchase, many offer basic functions such as billing, invoicing, inventory management, payroll, point-of sale, financial reporting, and processing of payroll. Here is a list of the most commonly used accounting packages.

Free Accounting Software: This software is typically free for personal use. Although it may not have all the functionality you need (e.g., you can't create your own reports), it is easy to use. If you are interested in analyzing your business' numbers, many programs allow you to directly download data to spreadsheets.

Paid accounting software: Paid accounts can be used by businesses with multiple employees. These accounts are powerful and can be used to track sales and expenses and generate reports. The majority of paid programs require a minimum one-year subscription fee. However, some companies offer subscriptions that are less than six months.

Cloud Accounting Software. Cloud accounting software allows for remote access to your files using any mobile device such as smartphones and tablets. This program is becoming increasingly popular due to its ability to save space on your computer hard drives, reduce clutter, and make remote work easier. No additional software is required. All you need is a reliable Internet connection and a device capable of accessing cloud storage services.

Desktop Accounting Software - Desktop accounting software runs locally on the computer. Desktop software is similar to cloud software. You can access your files from anywhere you want, even through mobile devices. The only difference is that you will have to install the software first before you can access it.

Mobile Accounting Software is designed to run on smaller devices, such as tablets and smartphones. These programs make it easy to manage your finances wherever you are. They have fewer functions that full-fledged desktop apps, but they're still extremely useful for people who travel often or run errands.

Online Accounting Software: This online accounting software is intended primarily for small business. It has all the features of a traditional desktop software package, but with a few additional bells and whistles. One advantage of online software is that it requires no installation; simply log onto the site and start using the program. You can also save money and avoid the overheads of a local office.