Are you looking for part-time bookkeeper salaries? Here is what you need to know about this career choice. You can find out more about the job description, location, and pay rate by reading on. You might be amazed at the results. Our 3F lifestyle includes part-time bookkeepers. Below are the benefits to becoming a bookkeeper. You can start looking for a part-time job today. As a part-time bookkeeper, you can earn up to $15 an hour

Career path

Part-time bookkeeping is a great career choice for people with accounting experience who want to take on more challenging jobs. Bookkeepers can either make a living as part-time workers or start their own business, whether as a freelancer. She can also complete online courses or an apprenticeship at a company.

Bookkeepers have a flexible work schedule and can work part-time with flexible hours and flexible benefits. Part-time bookkeepers might choose to work regular hours for either an employer or freelancer as long they can accommodate their own schedules. Many bookkeepers decide to further their education and training in order to become accountants or management accountants. The opportunities for part-time bookkeepers are plentiful.

Job description

A part-time accountant is a flexible employee that works with clients. This position allows clients to interact with tax and accounting departments. The type of business they work at will affect the salary. They can also expect to work with smaller businesses and startups. They might also be working in an industry related to their specialty. This flexibility allows them to have a 3F lifestyle.

There are many different types of bookkeepers. They also vary in their experience. A bookkeeper with previous experience at a large manufacturing company may have the ability to track accounts receivables. However, someone who is new to the field might be more interested in creating financial reports or payroll. They are often paid higher hourly rates than those with less experience. They may also have specializations or advanced training. Part-time bookkeeper salaries are determined by their experience.

Locations

If you're looking for part-time bookkeeping work, there are several locations in which to apply. You can find a variety of part-time bookkeeper positions online, but it's always best to have a local reference when applying online. It is important to be familiar with the salary differences for each part-time job. The following are some of the most important points to consider when looking for a part-time bookkeeper position.

Rate of Pay

There is no one national average rate for part-time bookkeepers' pay. But states differ in how many they have and what they charge. California's large state will have higher salaries than Redding, San Francisco, Bakersfield, and Los Angeles. Job openings in Connecticut are similar to those in California. But, in smaller states, there is expected to be more demand.

The hourly rate for a part-time accountant varies depending on their experience, education, and certification. Bookkeepers in Massachusetts average $43 per hour. While a part-time bookkeeper may not be able to perform high-level accounting work for a small business, they may be required to provide support and help with projecting and reporting. Part-time bookkeepers can cause a significant increase in workload for the business owner.

FAQ

How much do accountants make?

Yes, accountants usually get paid hourly rates.

For complex financial statements, some accountants may charge more.

Sometimes accountants may be hired to perform specific tasks. An accountant might be hired by a public relations company to create a report that shows how their client is doing.

What is a Certified Public Accountant?

A certified public accountant (C.P.A.) A certified public accountant (C.P.A.) is an individual with special knowledge in accounting. He/she will assist businesses with making sound business decisions and prepare tax returns.

He/She also monitors the cash flow of the company and ensures that it runs smoothly.

What is the best way to keep books?

You'll need to have a few basic items in order to start keeping books. A notebook, pencils or a calculator are all you will need to start keeping books.

Statistics

- Given that over 40% of people in this career field have earned a bachelor's degree, we're listing a bachelor's degree in accounting as step one so you can be competitive in the job market. (yourfreecareertest.com)

- According to the BLS, accounting and auditing professionals reported a 2020 median annual salary of $73,560, which is nearly double that of the national average earnings for all workers.1 (rasmussen.edu)

- "Durham Technical Community College reported that the most difficult part of their job was not maintaining financial records, which accounted for 50 percent of their time. (kpmgspark.com)

- Employment of accountants and auditors is projected to grow four percent through 2029, according to the BLS—a rate of growth that is about average for all occupations nationwide.1 (rasmussen.edu)

- In fact, a TD Bank survey polled over 500 U.S. small business owners discovered that bookkeeping is their most hated, with the next most hated task falling a whopping 24% behind. (kpmgspark.com)

External Links

How To

Accounting for Small Businesses: How to Do It

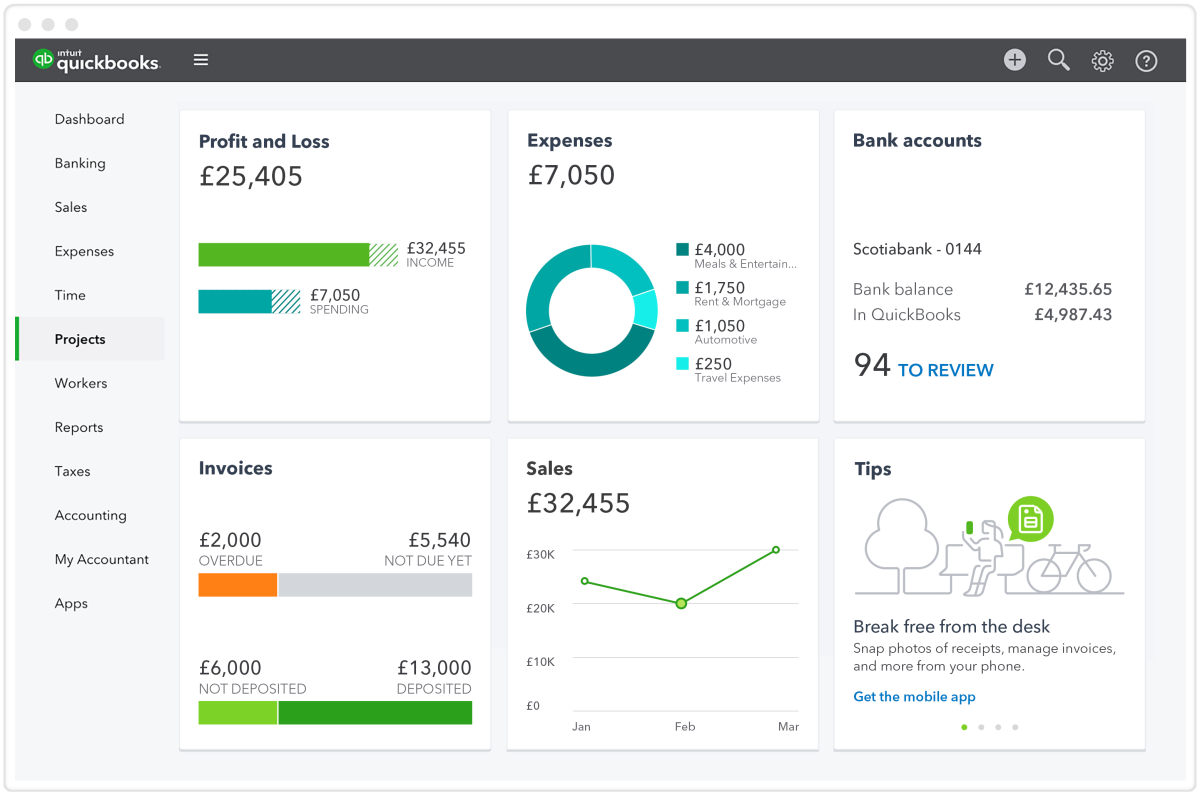

Accounting is a critical part of running a small business. This task includes keeping track of income and expenses, preparing financial reports, and paying taxes. You may also need to use software programs like Quickbooks Online. There are many ways you can go about doing your accounting for small businesses. You have to decide which method is best for you based on your specific needs. Below is a list of top methods that we recommend.

-

The paper accounting method is recommended. You may prefer paper accounting if you are looking for simplicity. This method is simple. You just need to keep track of your transactions each day. However, if you want to make sure that your records are complete and accurate, then you might want to invest in an accounting program like QuickBooks Online.

-

Online accounting is a great option. Using online accounting means that you can easily access your accounts at any time and anywhere. Wave Systems, Freshbooks, Xero, and Freshbooks are just a few of the popular options. These software allows you to manage your finances and generate reports. They offer great features and benefits, and they are easy to use. So if you want to save time and money when it comes to accounting, you should definitely try out these programs.

-

Use cloud accounting. Cloud accounting is another option. You can store your data securely on a remote server. Cloud accounting offers several advantages over traditional accounting systems. Cloud accounting isn't dependent on expensive software or hardware. You have better security since all your information can be accessed remotely. It takes the worry out of backups. It makes it easy to share files with others.

-

Use bookkeeping software. Bookkeeping software can be used in the same manner as cloud accounting. But, it is necessary to purchase a new computer and install it. After the software has been installed, you can connect to your internet account to access them whenever you like. You will also be able view your balance sheets and accounts directly from your computer.

-

Use spreadsheets. Spreadsheets enable you to manually enter your financial transactions. You can, for example, create a spreadsheet that allows you to enter sales figures each day. Another benefit of using a spreadsheet is the ability to make changes at will without needing an entire update.

-

Use a cash book. A cashbook is a ledger where you write down every transaction that you perform. There are many different shapes and sizes of cashbooks depending on how much room you have. You have the option of using a different notebook for each month, or a single notebook that covers several months.

-

Use a check register. You can use a check register as a tool to help you organize receipts or payments. You simply need to scan the items you receive into your scanner and then transfer them to your register. To help you remember what was bought, you can make notes once you have scanned the items.

-

Use a journal. Journals are a logbook that helps you keep track of your expenses. This is a good option if you have lots of recurring expenses like rent and insurance.

-

Use a diary. Use a diary. It is simply a notebook that you keep for yourself. It is useful for keeping track of your spending habits, and planning your budget.