CPA candidates must have at least two years experience working under a CPA to be eligible for the exam. The CPA test is a four-part 16-hour exam that is administered at designated testing centers across the globe. It is conducted in English, and consists of MCQs, simulation, and written ability questions.

Chartered Professional Accountant

You must pass the Uniform Certified Public Accountant Examination in order to be a Chartered Professional Accountant. This is a test for those who want to become public accountants in the United States. This is a rigorous exam, so it is important to study it carefully.

CPA certification can be beneficial for many reasons. A high demand exists for accountants with specific skills. These accountants are skilled in many other areas, such as business insight, management, strategic planning, and financial expertise. Obtaining a CPAA Certificate opens up new career opportunities within the accounting industry. It is possible to fake a certificate to claim that you are a CPAA.

The CPA exam consists of four sections and you must score 75 out of 90 to pass. You can also opt for a certificate, which consists of six online tests. The exams cover topics like assurance, taxation, law, business technology and management information systems. After passing these exams, you will be eligible for a Canadian CPAA practice permit.

CPAs can enjoy rewarding careers. They have many options for career choices. They can also choose to specialize in the not-for-profit sector. For more information on this certification, please contact your advisors.

International applicants need to meet the same educational requirements as national applicants. Regulation 20-281-23 of Connecticut State Board of Accountancy sets out these requirements. A baccalaureate degree must be obtained from an accredited higher education institution. This requirement may not be applicable to international applicants if the degree is earned outside the U.S.

Shelley Gibson manages the company's Quality, Safety and Health systems. She also has extensive experience in accounting and is currently studying for her Chartered Professional Accountant certificate. She works closely with contract managers, helping them to handle job inquiries, quote, and take care of their fleet.

Whether you are a working professional, student or a graduate, a Chartered Professional Accountant certification will help you excel in your field. A Chartered Professional Accountant certificate will allow you to become an entrepreneur or leader in your industry. McMaster University offers RPA approved accounting and finance degrees.

CPA certification programs combine education with relevant experience. The CPA designation is the most respected business and accounting credential in Canada. The combination of the best of tradition programs and the best of modern practices can lead to this designation. The CPA designation also requires practical experience and a capstone project.

FAQ

What is accounting's purpose?

Accounting provides an overview of financial performance by measuring, recording, analyzing, and reporting transactions between parties. It allows organizations to make informed financial decisions, such as whether to invest more money, how much income they will earn, and whether to raise additional capital.

Accountants track transactions in order provide financial activity information.

The organization can use the data to plan its future budget and business strategy.

It is vital that the data are reliable and accurate.

What are the different types of bookkeeping systems?

There are three main types in bookkeeping: computerized (manual), hybrid (computerized) and hybrid.

Manual bookkeeping refers to the use of pen & paper to record records. This method requires constant attention.

Computerized bookkeeping uses software programs to manage finances. It saves time and effort.

Hybrid accounting combines both computerized and manual methods.

What is the distinction between a CPA & Chartered Accountant, and how can you tell?

Chartered accountants are accountants who have passed all the necessary exams to get the designation. Chartered accountants are typically more experienced than CPAs.

A chartered accountant also holds himself out as being able to give advice regarding tax matters.

To complete a chartered accountant course, it takes about 6 years.

Accounting Is Useful for Small Business Owners

Accounting isn’t only for big businesses. Accounting is beneficial to small business owners as it helps them keep track and manage all the money they spend.

If your business is small, you already know how much money each month you make. What happens if an accountant isn't available to you? You may wonder where you're spending your money. You might forget to pay your bills on time which could negatively impact your credit rating.

Accounting software makes it easy to keep track of your finances. There are many options. Some are free and others can be purchased for hundreds or thousands of dollar.

It doesn't matter which accounting system you use; you need to know its basic functions. By doing this, you will not waste time learning how to operate it.

These are the basics of what you should do:

-

Input transactions into the accounting software.

-

Track your income and expenses.

-

Prepare reports.

After you have mastered these three points, you can start to use your new accounting software.

What does an auditor do?

An auditor looks for inconsistencies between the information given in the financial statements and the actual events.

He confirms the accuracy and completeness of the information provided by the company.

He also verifies that the company's financial statements are valid.

Statistics

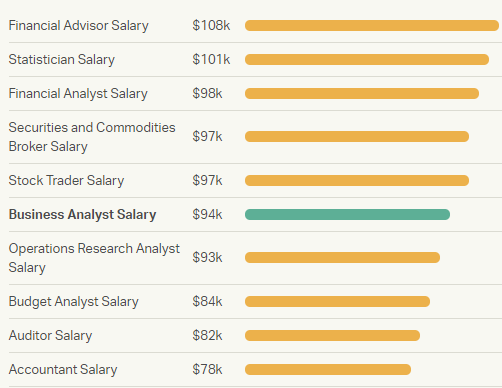

- Employment of accountants and auditors is projected to grow four percent through 2029, according to the BLS—a rate of growth that is about average for all occupations nationwide.1 (rasmussen.edu)

- Given that over 40% of people in this career field have earned a bachelor's degree, we're listing a bachelor's degree in accounting as step one so you can be competitive in the job market. (yourfreecareertest.com)

- "Durham Technical Community College reported that the most difficult part of their job was not maintaining financial records, which accounted for 50 percent of their time. (kpmgspark.com)

- BooksTime makes sure your numbers are 100% accurate (bookstime.com)

- a little over 40% of accountants have earned a bachelor's degree. (yourfreecareertest.com)

External Links

How To

How to do bookkeeping

There are many different types of accounting software. There are many types of accounting software available today. Some are free while others cost money. However, they all offer basic features like invoicing and billing, inventory management as well as payroll processing, point of sale systems and financial reporting. The following is a brief overview of the most widely used types of accounting software.

Free Accounting Software: Most accounting software is free and available for personal use. Although the program is limited in functionality (e.g. it cannot be used to create your reports), it can often be very easy for anyone to use. A lot of free programs can be used to download data directly to spreadsheets. This makes them very useful for anyone who wants to do their own analysis.

Paid Accounting Software: These accounts are for businesses that have multiple employees. They typically include powerful tools for managing employee records, tracking sales and expenses, generating reports, and automating processes. Although most paid programs require a minimum of one year to subscribe, there are many companies that offer subscriptions for as little as six months.

Cloud Accounting Software - Cloud accounting software lets you access your files via the internet from any device, including smartphones and tablets. This program is becoming more popular as it can save you space, reduce clutter, makes remote work much easier, and allows you to access your files from anywhere online. You don't even have to install any extra software. All you need is a reliable Internet connection and a device capable of accessing cloud storage services.

Desktop Accounting Software: Desktop accounting software is similar to cloud accounting software, except that it runs locally on your computer. Desktop software is similar to cloud software. You can access your files from anywhere you want, even through mobile devices. You will need to install the software on your PC before you can use it, however, unlike cloud software.

Mobile Accounting Software - Mobile accounting software is specially designed for small devices such as smartphones and tablets. These programs allow you to manage finances from anywhere. Typically, they provide fewer functions than full-fledged desktop programs, but they're still valuable for people who spend a lot of time traveling or running errands.

Online Accounting Software - Online accounting software was created primarily to serve small businesses. It includes everything that a traditional desktop package does plus a few extra bells and whistles. Online software doesn't need to be installed. All you have to do is log on and get started using it. You'll also save money by not having to pay for local office costs.