A bookkeeper is a job that comes with responsibilities. This professional can help you save time and keep your financial records. They will also report back to you any pertinent information. This will allow you to concentrate on building your business, not worrying about the details. These are the key responsibilities for a bookkeeper.

Job description

Bookkeepers are responsible for the management and control of a company’s financial records and accounts. This job does not involve the interpretation of financial data. Instead, the primary responsibility is to create financial records and track financial information. Bookkeepers typically work in conjunction with an accountant department or another firm to ensure company ledger accuracy and compliance with the finance laws. Bookkeepers handle basic administrative tasks such as invoices and payroll.

A bookkeeper must have the required education and experience. The job requires excellent organizational skills and the ability of managing deadlines. The exact job duties will vary according to the organization. However applicants should have some knowledge of accounting software. Depending on the type of organization, bookkeepers may also need to participate in meetings and training sessions. Any bookkeeper must have the right education and experience.

Job duties

The job of a bookkeeper may involve maintaining financial records and preparing tax returns. They are responsible for ensuring the financial health of the company, as well as preparing financial statements for the accountant. Their duties can range from one task to many, depending on the organization. Bookkeepers are often needed to help with payroll. A bookkeeper may also assist with other accounting duties such as the preparation of payroll checks or participation in meetings. You can apply for a position as a bookkeeper in a small business or startup. Or, you might be interested in a higher-ranking role.

Bookkeepers should emphasize integrity and honesty in their job descriptions. Bookkeepers must possess these qualities as they will need to accurately record financial information. This is a multi-faceted, highly skilled job that requires a strong organizational skill set and accuracy. Bookkeepers are responsible for maintaining accurate records and also prepare invoices, manage overdue accounts, and manage payroll.

Job description sample

A Bookkeeper job description is a short piece of writing that outlines the duties and responsibilities of the position. A brief summary should be included that outlines the job title, the main duties, hours, location and compensation. Bullet points are recommended if you can. Your Bookkeeper job description must include strong action verbs to attract qualified applicants. Here are some tips on how to write a bookkeeper job listing.

A sample job description for a bookkeeper is helpful, but it must be tailored to the company's needs. It should address the company's expectations and requirements. If you are writing a job description for yourself, you can use a bookkeeper job description sample to help you get started. You should edit your resume carefully to ensure you have clear ideas and are effective. A bookkeeper's responsibilities are so important that you include all details, including the date of their most recent meeting.

Job description for entry-level bookkeeper

A good job description is crucial to attracting qualified candidates. Bookkeepers have to be able and able work with different types of accounting software. Bookkeepers may need to attend meetings in addition to maintaining the accounts. Each company will have different duties. Therefore, it is important to list all education and relevant experience when you write your bookkeeper job descriptions. If applicable, the description should include details about what software you require.

The minimum qualification for an entry-level bookkeeper is a high school diploma or GED certificate, though some employers prefer candidates with an associate's degree in accounting or business administration. A bookkeeper should be able to organize well, pay attention to details, and have a good understanding of accounting principles. A bookkeeper can also choose to become a professional certified. The National Association of Certified Public Bookkeepers offers different certification levels, each requiring the completion of courses and a corresponding examination.

FAQ

What is an accountant and why are they so important?

An accountant keeps track all the money that you earn and spend. They also keep track of the tax you pay and any deductions.

An accountant helps manage your finances by keeping track of your income and expenses.

They assist in the preparation of financial reports for both individuals and businesses.

Accounting is a necessity because accountants must know all about numbers.

In addition, accountants help people file taxes and ensure they're paying as little tax as possible.

What is the purpose of accounting?

Accounting gives an overview of financial performance. It measures, records, analyzes, analyses, and reports transactions between parties. Accounting allows organizations make informed decisions about how much money to invest, how likely they are to earn from their operations, and whether or not they need to raise additional capital.

Accountants record transactions in order to provide information about financial activities.

The organization can use the collected data to plan its future strategy and budget.

It is essential that data be accurate and reliable.

What training do you need to become a bookkeeper

Basic math skills such as addition and subtraction, multiplication or division, fractions/percentages, simple algebra, and multiplication are essential for bookkeepers.

They must also be able to use a computer.

A majority of bookkeepers hold a high school diploma. Some even have college degrees.

What is a Certified Public Accountant?

A C.P.A. is a certified public accountant. An accountant is someone who has special knowledge in accounting. He/she can prepare tax returns for businesses and assist them in making sound business decisions.

He/She keeps an eye on the company's cash flow, and ensures that everything runs smoothly.

What does reconcile account mean?

A reconciliation is the comparison of two sets. One set is called the "source," and the other is called the "reconciled."

Source consists of actual figures. The reconciled is the figure that should have been used.

If you are owed $100 by someone, but receive $50 in return, you can reconcile it by subtracting $50 off $100.

This process ensures that there aren't any errors in the accounting system.

What is the importance of bookkeeping and accounting?

For any business, bookkeeping and accounting are crucial. They allow you to keep track of all transactions and expenses.

They can also help you avoid spending too much on unnecessary things.

You should know how much profit your sales have brought in. Also, you will need to know how much debt you owe other people.

If you don't have enough money coming in, then you might want to try raising prices. If you raise them too high, though, you might lose customers.

You might consider selling off inventory that is larger than you actually need.

If you have less than you need, you could cut back on certain services or products.

All these factors can impact your bottom line.

How does an accountant work?

Accountants work closely with their clients to make sure they get the most from their money.

They also work closely with professional such as attorneys, bankers or auditors.

They also assist internal departments such as human resources, marketing, sales, and customer service.

Balanced books are the responsibility of accountants.

They determine the tax due and collect it.

They also prepare financial reports that reflect how the company is doing financially.

Statistics

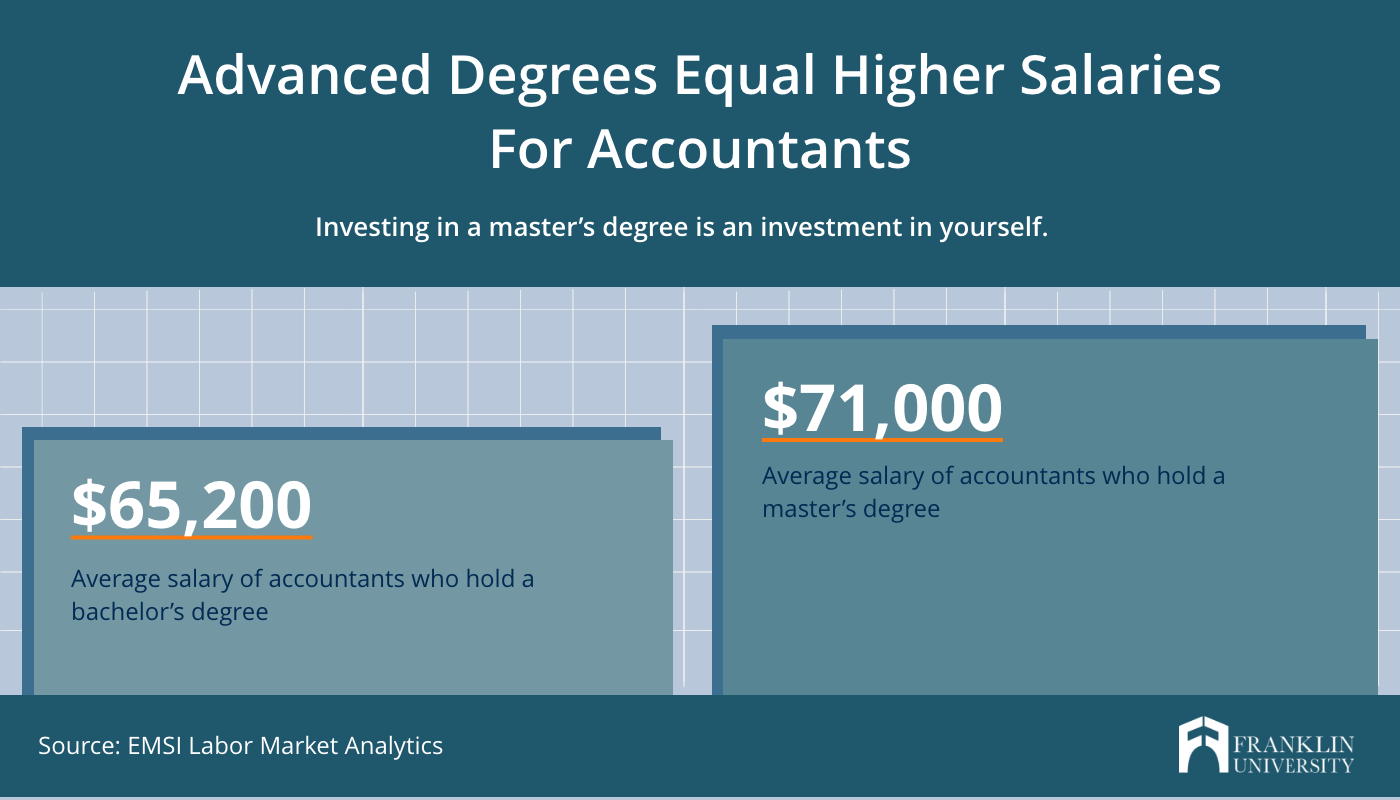

- According to the BLS, accounting and auditing professionals reported a 2020 median annual salary of $73,560, which is nearly double that of the national average earnings for all workers.1 (rasmussen.edu)

- Employment of accountants and auditors is projected to grow four percent through 2029, according to the BLS—a rate of growth that is about average for all occupations nationwide.1 (rasmussen.edu)

- Given that over 40% of people in this career field have earned a bachelor's degree, we're listing a bachelor's degree in accounting as step one so you can be competitive in the job market. (yourfreecareertest.com)

- "Durham Technical Community College reported that the most difficult part of their job was not maintaining financial records, which accounted for 50 percent of their time. (kpmgspark.com)

- a little over 40% of accountants have earned a bachelor's degree. (yourfreecareertest.com)

External Links

How To

How to do bookkeeping

There are many types of accounting software available today. While some software is free and some cost money to purchase, many offer basic functions such as billing, invoicing, inventory management, payroll, point-of sale, financial reporting, and processing of payroll. This list will give you a quick overview of some of the most popular accounting packages.

Free Accounting Software: This software is typically free for personal use. It may have limited functionality (for example, you cannot create your own reports), but it is often very easy to learn how to use. If you are interested in analyzing your business' numbers, many programs allow you to directly download data to spreadsheets.

Paid Accounting Software: These accounts are for businesses that have multiple employees. These accounts provide powerful tools for managing employee records and tracking sales and expenses. They also allow you to generate reports and automate processes. Many companies offer subscriptions with a shorter duration than six months, but most paid programs require a minimum subscription of at least one year.

Cloud Accounting Software. Cloud accounting software allows for remote access to your files using any mobile device such as smartphones and tablets. This program is becoming increasingly popular due to its ability to save space on your computer hard drives, reduce clutter, and make remote work easier. No additional software is required. You only need an internet connection and a device that can access cloud storage services.

Desktop Accounting Software: Desktop Accounting Software works on your computer, just like cloud accounting. Desktop software is similar to cloud software. You can access your files from anywhere you want, even through mobile devices. The only difference is that you will have to install the software first before you can access it.

Mobile Accounting Software: Mobile accounting software is specifically designed to run on small devices like smartphones and tablets. These programs allow you to manage finances from anywhere. They have fewer functions that full-fledged desktop apps, but they're still extremely useful for people who travel often or run errands.

Online Accounting Software: This software is primarily designed for small businesses. It offers all the functionality of a desktop program, plus some extra features. The best thing about online software is the fact that it does not require installation. You simply log in to the site to start the program. Online software also offers the opportunity to save money as you can avoid local office fees.