You can stand out from the crowd by earning a Master's of Accounting. This degree can be obtained online or on-campus from a number of schools. It may offer the flexibility and convenience that you are looking for. But, online learning is not the same as traditional classroom learning. Online learning requires that you set your own hours. You may not get timely reminders from professors.

Earning a master's degree in accounting has many benefits

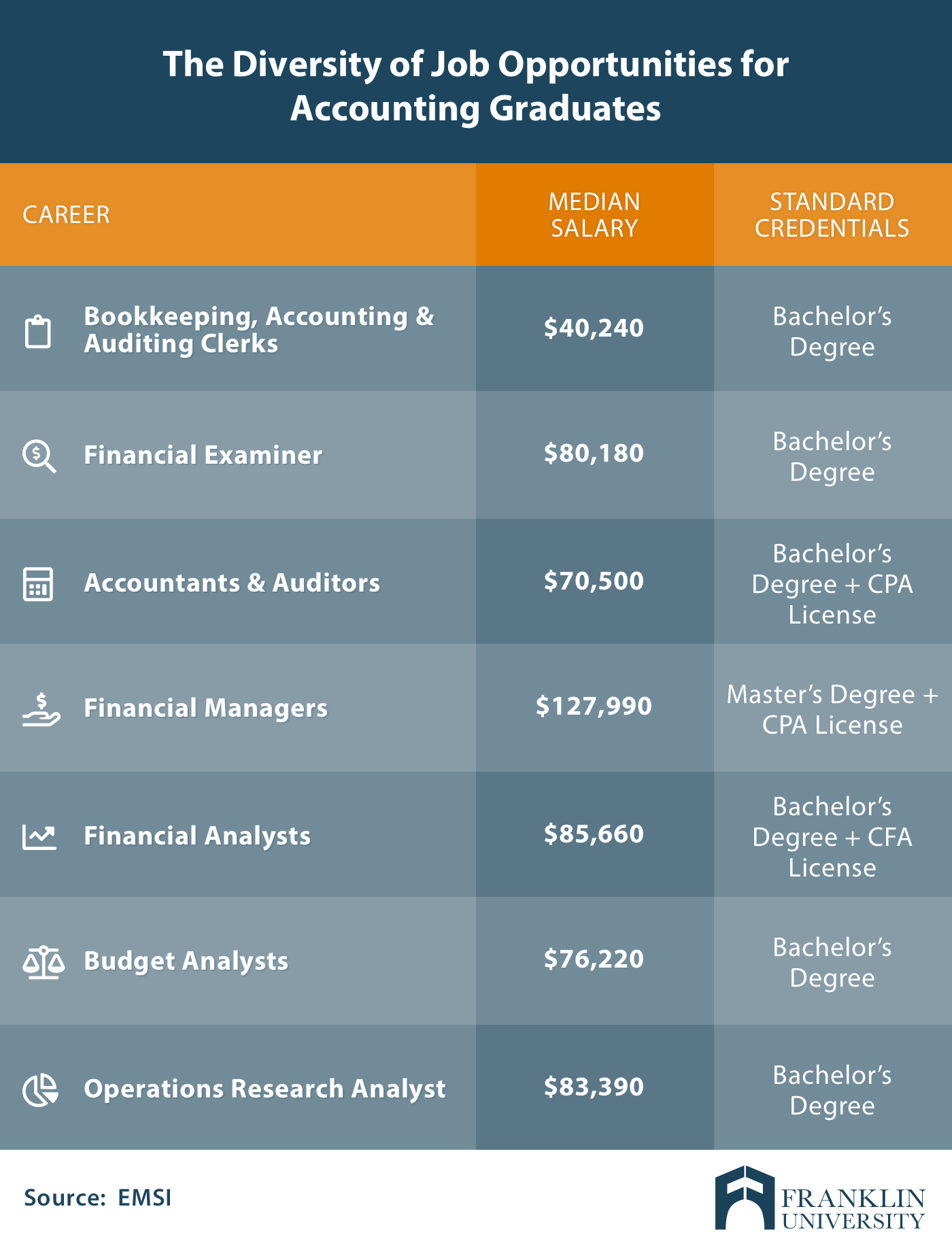

You can enhance your accounting knowledge and further your career by earning a master's level in accounting. Although a bachelor's degree will equip you with basic accounting knowledge, a masters degree will open up many job opportunities and increase your earning potential. Furthermore, a master's level in accounting will provide advanced skills for taxation and financial operation, which are both crucial areas of accounting.

The best thing about a master's program in accounting is its speed. It takes 12 to 18 months to complete a master's program. This time frame does not include the additional time needed for studying and homework.

Prerequisite coursework

If you are interested in pursuing a graduate degree in accounting, you might be wondering which courses you must take to get started with your program. Grad school is a rigorous program. Your undergraduate grades can be an indicator of your ability and willingness to take on graduate-level work. Don't worry if you didn't earn the best grades in your undergraduate classes; focus on the business and accounting courses you are taking.

Prerequisite coursework for master’s degrees in accounting includes a four year bachelor's from a regionally accredited college. A minimum grade point average (on a 4-point scale) of 3.0 is required for students to be eligible for a master's degree in accounting. Students also need to demonstrate English language proficiency. If you're applying for a master's in accounting, you may be required to take the GMAT or GRE exam.

Concentrations available

There are many concentrations offered in master's degrees in accounting. How you decide which one to focus on will depend on what interests you have, your strengths and your professional goals. Focusing on taxation, management, cost accounting or other areas of interest may be a good idea. An information systems concentration is an option for those who are skilled in information technology. Another option is to choose a concentration focusing on the environment or sports.

Concentrations available in master's in accounting vary from school to school, but most of them offer students the chance to choose a specific area of study. One example is taxation. It prepares students for a career both in taxation and auditing. Some students might choose to study taxation as part their accounting program. This will prepare them for the CPA exam.

Online programs

Online Master's degrees in accounting are an option for professionals who want to further their careers. These programs have flexible schedules and many are also accredited through the AACSB. Master's degrees in accounting can be used to train students in many areas of the accounting industry, such as taxation analysis and financial statements.

The tuition rates and credits required for online programs differ. Online programs usually cost around $500 per semester. Some programs, however, can be as much as $1,800 per credits. This could result in tuition costs ranging from $24,000 up to $72,000.

FAQ

What does an auditor do?

An auditor looks for inconsistencies between the information given in the financial statements and the actual events.

He checks the accuracy of the figures provided by the company.

He also validates the validity and reliability of the company's financial statements.

What is the difference between a CPA and a Chartered Accountant?

Chartered accountants are professional accountants who have passed the required exams to earn the designation. Chartered accountants have more experience than CPAs.

Chartered accountants are also qualified in tax matters.

It takes 6 to 7 years to complete a chartered accounting course.

What is the work of accountants?

Accountants work with clients in order to get the best out of their money.

They work closely alongside professionals like bankers, attorneys, auditors and appraisers.

They also interact with departments within the company, such as sales and marketing.

Accounting professionals are responsible for maintaining balance in the books.

They determine how much tax must be paid, and then collect it.

They also prepare financial statements which show how well the company is performing financially.

What is bookkeeping?

Bookkeeping is the practice of maintaining records of financial transactions for businesses, organizations, individuals, etc. It includes all business expenses and income.

Bookkeepers track all financial information such as receipts, invoices, bills, payments, deposits, interest earned on investments, etc. They also prepare tax reports and other reports.

How Do I Know If My Company Needs An Accountant?

Many companies hire accountants when they reach certain size levels. One example is a company that has annual sales of $10 million or more.

However, some companies hire accountants regardless of their size. These include sole proprietorships or partnerships, small firms, corporations, and large companies.

A company's size does not matter. Only important is the use of accounting systems.

If so, then the company should hire an accountant. And it won't.

What is an auditor?

An audit is an examination of the financial statements of a company. Auditors examine the financial statements of a company to verify that they are correct.

Auditors search for discrepancies between the reported events and the actual ones.

They also check whether the company's financial statements are prepared correctly.

Statistics

- a little over 40% of accountants have earned a bachelor's degree. (yourfreecareertest.com)

- The U.S. Bureau of Labor Statistics (BLS) projects an additional 96,000 positions for accountants and auditors between 2020 and 2030, representing job growth of 7%. (onlinemasters.ohio.edu)

- Given that over 40% of people in this career field have earned a bachelor's degree, we're listing a bachelor's degree in accounting as step one so you can be competitive in the job market. (yourfreecareertest.com)

- Employment of accountants and auditors is projected to grow four percent through 2029, according to the BLS—a rate of growth that is about average for all occupations nationwide.1 (rasmussen.edu)

- "Durham Technical Community College reported that the most difficult part of their job was not maintaining financial records, which accounted for 50 percent of their time. (kpmgspark.com)

External Links

How To

The Best Way To Do Accounting

Accounting is a system of processes that allows businesses to accurately record transactions and keep track of them. It includes recording income and expenses, keeping records of sales revenue and expenditures, preparing financial statements, and analyzing data.

This includes reporting financial results to investors, shareholders, lenders, customers, and other stakeholders.

There are many ways to do accounting. There are many ways to do accounting.

-

Create spreadsheets manually

-

Excel can be used.

-

Notes on paper for handwriting

-

Use computerized accounting systems.

-

Online accounting services.

Accounting can be done many ways. Each method comes with its own set of advantages and disadvantages. It all depends on what your business needs are and how you run it. Before you decide on any one method, consider all the pros and disadvantages.

Accounting methods are not only more efficient, they can also be used for other reasons. If you're self-employed, for example, it might be a good idea to keep accurate books as they can provide proof of your work. Simple accounting techniques may work best for small businesses, especially if they don't have much money. You might prefer to use complicated accounting methods if you have a large business that generates large amounts.