Every small business borrows money at times. Most businesses borrow money to purchase fixed assets. Because the loan amount is often a long-term liability and it takes time to record and process the payments, there are several steps. You'll need a suspense fund depending on the type and amount of your loan. This account holds value that is awaiting a future transaction. See the following examples for more information. In accounting, there are several transactions that require the use of suspense account.

Tax knowledge in bookkeeping account

The state of tax education in New Zealand today is very different to that of other countries. Few comparative studies have been conducted and little is known about the content covered in New Zealand's first tax courses. This knowledge gap was the purpose of this study. The purpose of the study was to find out what students need in order to do their bookkeeping accounting tasks effectively. The study also examined whether the expectations of tax professionals are being met.

A tax accounting course is one way to increase your tax knowledge. This course is usually completed in a week. It reinforces the information you have received from previous classes. It is an excellent choice for students, managers, and business owners who want to gain a better understanding of taxation. The field of taxation changes constantly so it is important to keep your knowledge current. Continuing your education will help you to provide the highest level of service to your clientele.

Classification of bookkeeping books

The organization of company books is the basis of their bookkeeping accounts. These accounts include balance sheets accounts, nominal accounts, income and expense accounts. Because they are the income and expense accounts of a business, nominal accounts are the most common. They are sometimes called real accounts. They are used to prepare financial statements such profit and loss.

First, you need to create a chart. A chart is a list that lists all the accounts in a company. Each account is categorized according to its purpose. These accounts are divided according to their purpose, depending on the size of your business. Some journals are categorized according to their intended purpose. Assets fall under the asset category, while expenses fall under expense.

Recording of transactions

Recording transactions is critical in an accounting process. Financial statements that are inaccurate could be caused by mistakes in the recording process. Accounting professionals must understand the purpose of recording. The recording process is done in order to analyze the transactions. The accounting equation is used to analyze these transactions. In this article, we will examine the purpose of recording in detail. Here are some examples.

First, you need to decide which transactions must be recorded. These could be bills, sales orders or cash register tapes. These records are then recorded in journals, ledgers, and trial balances. Small businesses might use a simple cash register. After all the records are compiled, financial statements will be made. However, some businesses may choose to record transactions in different journals.

Trial balance

What is a trial account balance? A trial balance can simply be described as a list containing the nominal ledgers. Each account in the list contains a debit or credit balance. Also, the name and number of the nominal ledger accounts are listed on the trial balanced. You can see a trial balance by clicking on the link below:

The trial balance can be used to determine if you have any errors in your bookkeeping records. A trial balance should have a balance of zero. However, there may be miscalculations that could cause it to not be zero. If you see a trial balance that is non-zero, this means that you may have incorrectly entered an amount or transposed a row. The difference between debit and credit columns will help you determine where the error originated.

FAQ

What does an auditor do exactly?

An auditor looks for inconsistencies between the information given in the financial statements and the actual events.

He checks the accuracy of the figures provided by the company.

He also checks the validity of financial statements.

What is reconciliation?

It's very important because you never know when mistakes happen. Mistakes include incorrect entries, missing entries, duplicate entries, etc.

These problems can have serious consequences such as inaccurate financial statements, missed deadlines and overspending.

What is a Certified Public Accountant, and what does it mean?

Certified public accountant (C.P.A.). is a person with specialized knowledge in accounting. He/she can prepare tax returns for businesses and assist them in making sound business decisions.

He/She also monitors the cash flow of the company and ensures that it runs smoothly.

Statistics

- "Durham Technical Community College reported that the most difficult part of their job was not maintaining financial records, which accounted for 50 percent of their time. (kpmgspark.com)

- The U.S. Bureau of Labor Statistics (BLS) projects an additional 96,000 positions for accountants and auditors between 2020 and 2030, representing job growth of 7%. (onlinemasters.ohio.edu)

- a little over 40% of accountants have earned a bachelor's degree. (yourfreecareertest.com)

- a little over 40% of accountants have earned a bachelor's degree. (yourfreecareertest.com)

- Given that over 40% of people in this career field have earned a bachelor's degree, we're listing a bachelor's degree in accounting as step one so you can be competitive in the job market. (yourfreecareertest.com)

External Links

How To

Accounting: The Best Way

Accounting is a collection of processes and procedures that businesses use to record and track transactions. Accounting involves recording income and expense, keeping track sales revenue and expenditures and preparing financial statements.

It also involves reporting financial data to stakeholders such shareholders, lenders investors customers, investors and others.

There are many ways to do accounting. Some of these are:

-

Create spreadsheets manually

-

Using software like Excel.

-

Notes on paper for handwriting

-

Using computerized accounting system.

-

Using online accounting services.

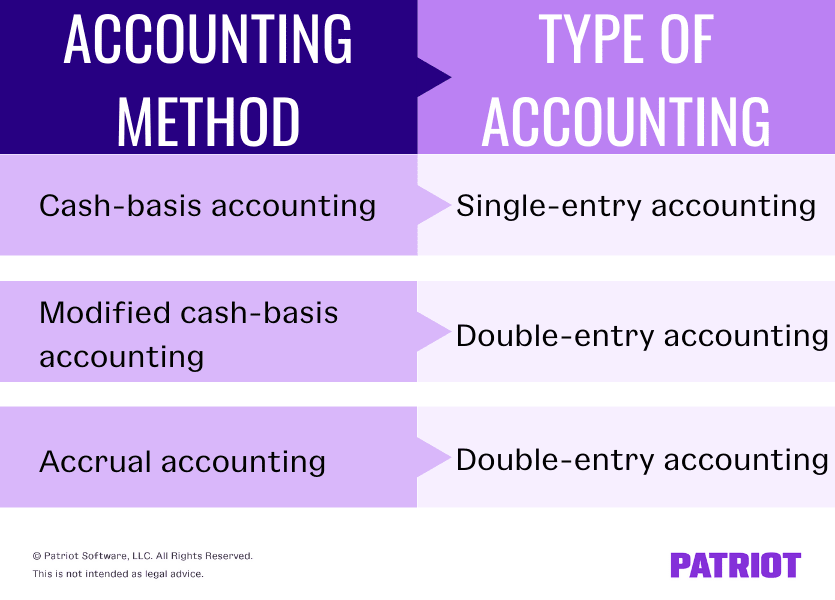

Accounting can be done in several ways. Each method has its own advantages and drawbacks. The type of business you have and the needs of your company will determine which method you choose. Before you choose any method, it is important to weigh the pros and cons.

Accounting methods are not only more efficient, they can also be used for other reasons. Self-employed people might prefer to keep detailed books, as they are evidence of the work you have done. Simple accounting is best for small businesses with little money. Complex accounting is better if your company generates large cash flows.