Bookkeeping automation can help your business in several ways. Automation reduces administrative burden, increases efficiency, and reduces vulnerabilities. It can integrate with other ERP system. This article will outline some of the many benefits of automating your bookkeeping. This article will help you make an informed decision about whether automation is right in your company.

Automating bookkeeping reduces administrative burdens

Automating bookkeeping can help reduce administrative burdens in a company. Manual processes are time-consuming and require significant energy. You can optimize your employees' time by automating your bookkeeping and improve your bottom-line. These are just a few reasons to automate your bookkeeping.

Automation reduces human error, administrative burdens, and saves time. Automation allows you to concentrate on your business while still having time for other tasks. The software can identify patterns and trend and produce reports and interpretations to help you.

It reduces vulnerabilities

Automated bookkeeping has brought about many benefits. They include reduced costs and more efficient operations. Automation has many benefits, including reducing vulnerabilities. While humans may be prone to human error, automation reduces this risk by eliminating the need for human intervention. Automating access revocation procedures, for example, eliminates the need to have human intervention and allows organizations reduce the risk of human error.

It enhances efficiency

Automated software for accounting can help you simplify and streamline repetitive tasks such expense management. It also reduces the need for paper receipts and minimizes manual data entry. In addition, the software also helps you manage payroll, which is often a time-consuming, repetitive task. Integrating the accounting software in your workflow allows you to focus on your business and not worrying about paperwork.

Automating bookkeeping tasks can help you free up your staff for more productive tasks. Skilled accounting staff can spend their time researching and reporting, instead of manually entering data. This can dramatically improve your company's efficiency. According to Small Business Trends 44% of professionals and employees said automation made their jobs easier.

It can be integrated with other ERP systems

Bookkeeping automation can make your life easier by automating many of the processes associated with bookkeeping. Automating your bookkeeping processes can reduce human error which can negatively impact your business. Additionally, automation allows you to free up employees to perform other vital duties.

Integrations between accounting, finance and other departments can simplify internal workflows. They also aid in forecasting and predictive planning. You won't have to depend on sales to update revenue records. They can view all data in one place. This will make accounting more efficient since it won't need to constantly call other departments for updates.

It allows for real-time transaction and syncing

Businesses can save time and money by having real-time transactions synced. Companies that rely on manual bookkeeping can have large gaps in their tracking of transactions. Businesses can use finance automation software to enable real-time transaction and categorization.

This feature is essential and will save you time when reconciling month-end statements. The two-way syncing between your accounting software and your payment platform will ensure accurate payment records. This type of integration can save you time when entering data and will eliminate the need for switching platforms.

FAQ

Accounting: Why is it useful for small-business owners?

The most important thing you need to know about accounting is that it's not just for big businesses. It's also useful for small business owners because it helps them keep track of all the money they make and spend.

If you own a small business, then you probably already know how much money you have coming in each month. But what happens if you don’t have a professional accountant to help you with this? You might be wondering about your spending habits. Or, you might neglect to pay your bills in time, which could affect your credit rating.

Accounting software makes keeping track of your finances easy. There are many options. Some are completely free, while others can cost hundreds of thousands of dollars.

No matter what type of accounting system, it is important to first understand the basics. This way, you won't waste time learning how to use it.

These are the basics of what you should do:

-

Record transactions in the accounting system.

-

Track income and expenses.

-

Prepare reports.

These are the three essential steps to get your new accounting system up and running.

How Do I Know If My Company Needs An Accountant?

Many companies hire accountants when they reach certain size levels. If a company has $10 million annual sales or more, it will need one.

However, not all companies need accountants. These include small companies, sole proprietorships as well partnerships and corporations.

It doesn't matter what size a company has. The only thing that matters is whether the company uses accounting systems.

If so, then the company should hire an accountant. And it won't.

How do accountants work?

Accountants partner with clients to help them get the most out their money.

They work closely with professionals such as lawyers, bankers, auditors, and appraisers.

They also collaborate with other departments such as marketing and human resources.

Accountants are responsible in ensuring that books are balanced.

They determine how much tax must be paid, and then collect it.

They also prepare financial statement that shows how the company is performing.

Statistics

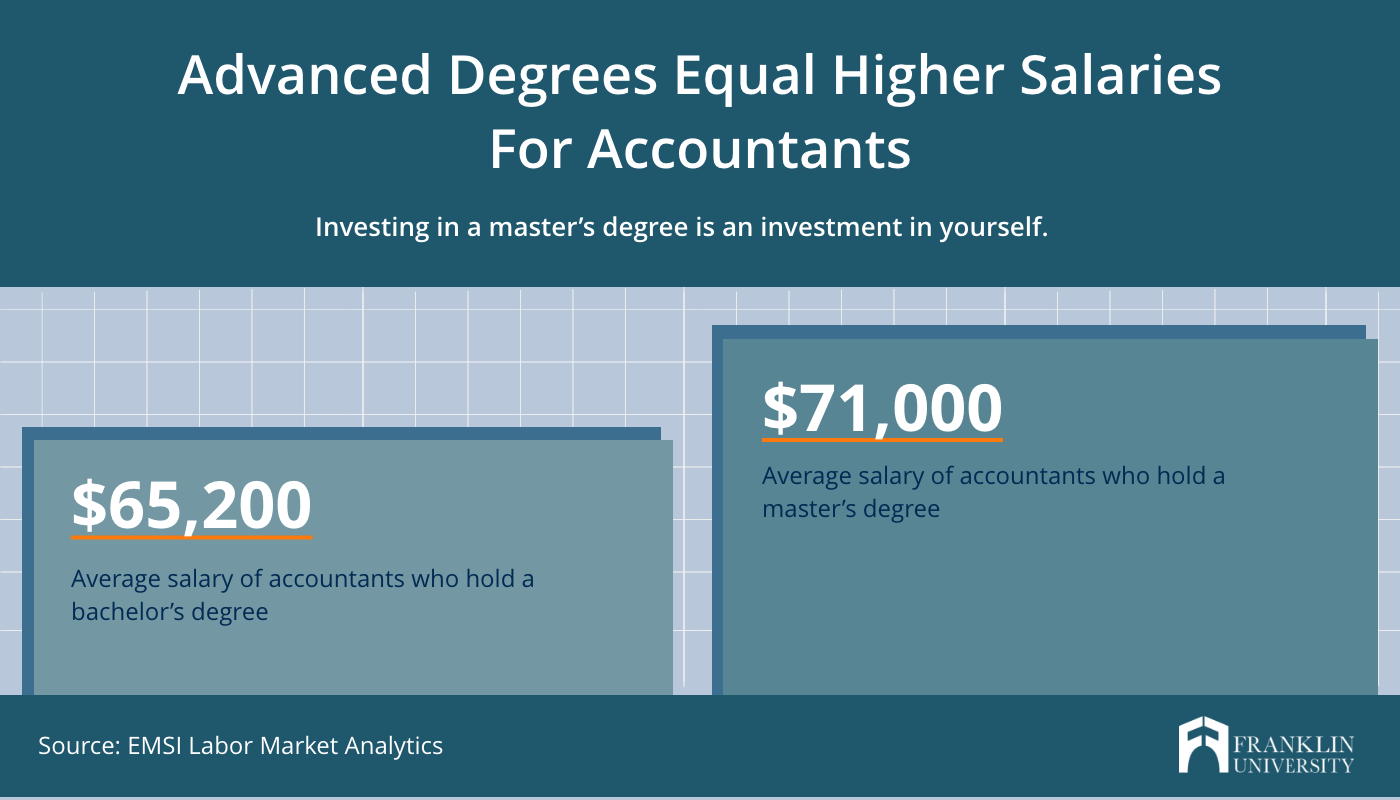

- Given that over 40% of people in this career field have earned a bachelor's degree, we're listing a bachelor's degree in accounting as step one so you can be competitive in the job market. (yourfreecareertest.com)

- "Durham Technical Community College reported that the most difficult part of their job was not maintaining financial records, which accounted for 50 percent of their time. (kpmgspark.com)

- a little over 40% of accountants have earned a bachelor's degree. (yourfreecareertest.com)

- Employment of accountants and auditors is projected to grow four percent through 2029, according to the BLS—a rate of growth that is about average for all occupations nationwide.1 (rasmussen.edu)

- According to the BLS, accounting and auditing professionals reported a 2020 median annual salary of $73,560, which is nearly double that of the national average earnings for all workers.1 (rasmussen.edu)

External Links

How To

How to Become an Accountant

Accountancy is the science of recording transactions and analyzing financial data. It involves the preparation and maintenance of various reports and statements.

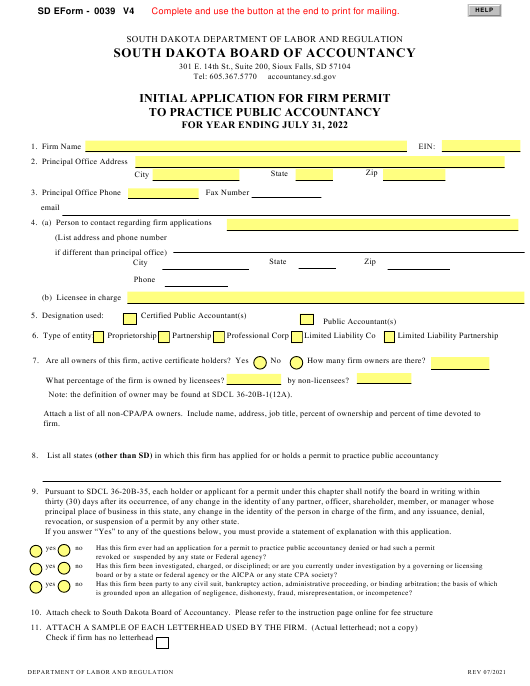

A Certified Public Accountant (CPA), is someone who has passed a CPA exam and is licensed by the state boards of accounting.

An Accredited financial analyst (AFA), or an individual who meets the requirements of the American Association of Individual Investors, is an individual who is accredited by Financial Analysts. The AAII requires that individuals have at least five years of investment experience before becoming an AFA. A series of exams is required to assess their knowledge of securities analysis and accounting principles.

A Chartered Professional Accountant (CPA), also known as a chartered accounting, is a professional accountant with a degree from a recognized university. The Institute of Chartered Accountants of England & Wales (ICAEW) has established specific educational standards for CPAs.

A Certified Management Accountant (CMA), is a certified professional accountant that specializes in management accounting. CMAs must pass exams administered annually by the ICAEW. They also need to continue continuing education throughout their careers.

A Certified General Accountant, (CGA), is a member of American Institute of Certified Public Accountants. CGAs must take multiple tests. One of these is the Uniform Certification Examination (UCE).

International Society of Cost Estimators, (ISCES), offers the Certified Information Systems Auditor (CIA), a certification. Candidates for the CIA need to complete three levels in order to be eligible. These include practical training, coursework and a final examination.

An Accredited Corporate Compliance Officer (ACCO) is a designation granted by the ACCO Foundation and the International Organization of Securities Commissions (IOSCO). ACOs are required to hold a baccalaureate degree in finance, business administration, economics, or public policy and must pass two written exams and one oral exam.

The National Association of State Boards of Accountancy's Certified Fraud Examiner credential (CFE), is awarded by NASBA. Candidates must pass three exams and obtain a minimum score of 70 percent.

International Federation of Accountants is accredited a Certified Internal Audior (CIA). The four-part exam covers topics such as auditing (auditing), risk assessment, fraud prevention and ethics, and compliance.

American Academy of Forensic Sciences' (AAFS), designates Associate in Forensic Analysis (AFE). AFEs should have a bachelor's degree from an accredited college, university or other educational institution in any area of study.

What does an auditor do exactly? Auditors are professionals that audit organizations' financial reporting. Audits can take place on an individual basis or on the basis of complaints received from regulators.