If you are looking to pursue a career within forensic accounting you have found the right place. This article contains information about the BS or MS degrees in forensic account, as well as the costs involved. You will also learn what you can do after you graduate. The financial costs associated with these degrees are relatively low, and the degree itself will prepare you for a number of different jobs in forensic accounting.

BS in Forensic Accounting

Carlow University's BS in Forensic Accounting is for professionals and undergraduates who wish to specialize in this area. The program teaches the fundamentals and principles of accounting, business ethics, and fraud detection and prevention. Students learn about management, economics and technology. Once they complete the program, they'll be well prepared to work in a variety of settings.

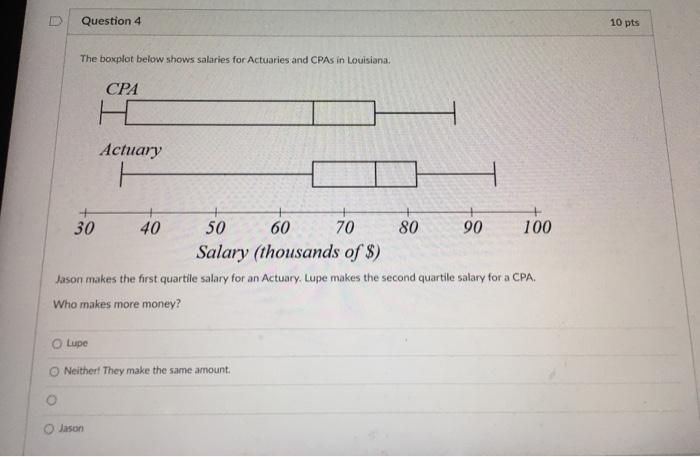

The tuition cost for a fouryear BSc in forensic accounting can be between twenty-five thousands and one hundred 000 dollars. Tuition rates can vary greatly between institutions and out-of state students will pay less. However, online schools don't differentiate between in-state and outside-state students.

MS in Forensic Accounting

New England College's MS program in Forensic Accounting builds off traditional accounting training to prepare students as financial auditors, and financial investigators. The program integrates the disciplines of accounting and law to aid students in developing their analytical skills. It also helps them spot fraud and financial transactions. They also improve their ability to communicate their findings clearly in prepared statements.

As well as performing third-party audits of business funds and financial transactions by third parties, forensic accountants analyze documents and prepare evidence to support court cases. For this job to succeed, they need strong mathematical skills as well as a thorough understanding of the legal process.

Cost of a degree in forensic accounting

Forensic accounting degree programs are available at several colleges and universities around the country. Students pursuing this type of degree can focus on financial statement analysis and fraud investigation. Some schools offer internships. Students who graduate from a top university could find lucrative work in the accounting industry.

A bachelor's program in forensic accountant typically costs between $18,837 - $45,570. If the student is a resident of an in-state state, the cost of a degree in forensic accounting is less. Students can transfer credits from other colleges or use available financing options to reduce the cost of a forensic accountant program. Many schools offer merit-based scholarships.

Career options after a forensic accounting degree

After graduation, you have many options for forensic accounting careers. Forensic and criminal accountants work in both government and business. Some work for the US Securities and Exchange Commission. They uncover corporate fraud. It is a challenging job, but it offers great rewards and is rewarding.

This area of expertise is relatively new. This field blends the expertise of an experienced accountant/auditor with legal expertise. They are often hired by corporations to investigate suspected fraud or to protect their finances.

FAQ

How can I find out if my business needs an accountant

Companies often hire accountants once they reach certain sizes. One example is a company that has annual sales of $10 million or more.

However, some companies hire accountants regardless of their size. These include small companies, sole proprietorships as well partnerships and corporations.

A company's size doesn't matter. Only what matters is whether or not the company uses accounting software.

If it does, then the company needs an accountant. A different scenario is not possible.

What is an auditor?

Auditors look for inconsistencies between financial statements and actual events.

He confirms the accuracy and completeness of the information provided by the company.

He also validates the validity and reliability of the company's financial statements.

What does reconcile account mean?

Reconciliation is the process of comparing two sets numbers. One set is called "source" and the other the "reconciled."

Source consists of actual figures. The reconciled is the figure that should have been used.

If you are owed $100 by someone, but receive $50 in return, you can reconcile it by subtracting $50 off $100.

This ensures there are no errors in the accounting system.

Statistics

- a little over 40% of accountants have earned a bachelor's degree. (yourfreecareertest.com)

- Given that over 40% of people in this career field have earned a bachelor's degree, we're listing a bachelor's degree in accounting as step one so you can be competitive in the job market. (yourfreecareertest.com)

- In fact, a TD Bank survey polled over 500 U.S. small business owners discovered that bookkeeping is their most hated, with the next most hated task falling a whopping 24% behind. (kpmgspark.com)

- Employment of accountants and auditors is projected to grow four percent through 2029, according to the BLS—a rate of growth that is about average for all occupations nationwide.1 (rasmussen.edu)

- Given that over 40% of people in this career field have earned a bachelor's degree, we're listing a bachelor's degree in accounting as step one so you can be competitive in the job market. (yourfreecareertest.com)

External Links

How To

Accounting for Small Business: What is the best way to do it?

Accounting for small businesses should be one of your most important tasks when managing a business. This includes tracking income and expenses, preparing financial statements, and paying taxes. This task also requires the use of software programs, such as Quickbooks Online. There are many options for accounting small businesses. You must choose the right method for you, based on your requirements. Here are some top options that you can consider.

-

Use the paper accounting system. If you want to keep things simple, then using paper accounting may work well for you. The process of using this method is very easy; you just need to record your transactions daily. A QuickBooks Online accounting program is a good option if your records need to be complete and accurate.

-

Use online accounting. Online accounting makes it easy to access your accounts anywhere, anytime. Wave Systems, Freshbooks, Xero, and Freshbooks are just a few of the popular options. These types of software allow you to manage your finances, pay bills, send invoices, generate reports, and much more. These programs offer many features and benefits. They also make it easy to use. These programs will help you save both time and money in accounting.

-

Use cloud accounting. Another option is cloud accounting. Cloud accounting allows you to securely store your data on remote servers. Cloud accounting offers many benefits over traditional accounting systems. Cloud accounting does not require that you purchase expensive software or hardware. Because all your information is stored remotely, it provides better security. It takes the worry out of backups. Fourth, it makes sharing files easier.

-

Use bookkeeping software. Bookkeeping software is similar with cloud accounting. However you must purchase a computer in order to install the software. Once the software is installed, you will have access to the internet to view your accounts whenever and wherever you like. You will also be able view your balance sheets and accounts directly from your computer.

-

Use spreadsheets. Spreadsheets allow you to enter your financial transactions manually. To illustrate, you could create a spreadsheet in which you can record your sales figures daily. A spreadsheet's advantage is that you can make changes to them at any time without having to change the whole document.

-

Use a cash book. A cashbook is a ledger where you write down every transaction that you perform. Cashbooks come with different sizes and shapes, depending on how many pages you have. You can choose to use separate notebooks for each months or one notebook that spans multiple years.

-

Use a check register. A check register is a tool that helps you organize receipts and payments. All you need to do is scan the items received into your scanner, and you can transfer them to your check register. You can also add notes to help you recall what you purchased.

-

Use a journal. You can keep track of all your expenses by using a journal. This is best for those who have recurring expenses like rent, insurance, and utilities.

-

Use a diary. Keep a journal. You can use it for tracking your spending habits or planning your budget.