What are the functions of accounting? Accounting is a tool that helps to determine the profitability of a company. An accounting procedure provides useful information to its intended users. These users use this information to make financial forecasts and invest decisions. Here are some examples. Listed below are some of the common uses of accounting. Continue reading if you'd like to know more. But before you read on, let's take a moment to understand why accounting is important.

Accounting is the language used in business

Mason, Davidson, Scinder and Scinder agree that accounting is the language in which business operates. Financial statements and reports can tell the whole story of any business, industry, country. These documents provide information about revenue and expenses, debt vs. revenues, and costs associated with retaining customers. Decision-making without these documents would be difficult and erratic. Understanding accounting can make it easier for businesses to make informed decisions.

It is sometimes called the language for business, as financial records tell the story behind a company’s financial health. Financial statements are an essential part for executive's jobs. They are vital for all who want to communicate in business. This language is universal and vital for all businesspeople. Accounting is the language of business. However it is not just one language. Accounting is necessary for all businesses.

It aids in capital allocation decisions

Capital Asset Allocation (CAA) is designed to increase shareholder value over a long period. CA is used to make investments in the business, buy intangibles, and trade in mispriced security. The goal is to maximise return on investment and reduce risk. Investors who are savvy focus on the investment decisions made and their impact. They consider all factors, including their ability or inability to invest in a business or its assets.

Financial reporting is essential for capital allocation decisions. Financial reporting is an important tool in decision-making, as accurate financial information attracts capital. Poorly reported financial information can negatively impact the securities market and negatively affect capital allocation decisions. Management and other stakeholders also find financial information useful because it can be used to provide performance incentives or for keeping certain employees in their jobs. Accounting is vital for capital allocation decisions. However, there are still some who doubt the value of accounting in capital allocation.

It's useful for financial forecasting

Businesses can't be profitable and not have accurate financial forecasts. Business owners can plan for the future with accurate forecasts and be more attractive to investors. Companies can also negotiate better office leases and appropriately size their insurance coverage with a strong financial plan. A strong financial plan includes accounting. These are just a few ways that accounting can aid in financial forecasting. These three factors will help businesses increase their profit margins.

Net working capital is the difference between current assets or liabilities. Historical data can be used for projections of net working capital. A standard practice is to use two years of past financial information. Past net working capital numbers can be used to project a precise figure for future periods. Be sure to include all assumptions when creating financial forecasts. Creating a forecasted plan is difficult without a basis to build on.

It's a great way to determine profitability

Decision-makers are required to have reliable, accurate information to be able to make informed business decisions. Owners should also have a clear understanding of the entire cost of creating a product or service, including fixed and variable costs. These latter are not affected or subject to seasonality, and they don't depend on how much labor is used. Cost accounting is a tool that helps to reduce costs and boost profitability. We'll be discussing how accounting can help businesses determine profitability in the next paragraphs.

As a business owner, one of your main goals should be to increase profits. As a C-suite leader or executive director, determining profitability is imperative to your success. Profitability is the main source of motivation in any firm, and knowing how to assess profitability is crucial. Cost accounting, which is a management tool that assesses all costs associated to producing a product/service, is key to measuring profitability. Cost accounting, among other functions, measures production costs.

It's helpful when calculating taxes

On an ongoing basis, companies must pay sales and payroll taxes. These taxes are imposed at the state, local and national level. Accounting standards are critical in determining the correct tax rate. The tax rate is calculated by businesses to minimize their income tax expense, and to ensure they pay the correct tax amount. Accounting can help you calculate taxes through many different processes including sales tax, income tax, and employment taxes.

Accounting for income taxes can be used by businesses to increase their profits and reduce their tax liability. Some countries impose only one tax on companies, while others allow companies to claim input tax credits for raw materials. Regardless of the country in which a company does business, income tax accounting allows companies to minimize their tax liability, which ultimately results in higher profits. Additionally, companies are required to keep two sets books of account. This increases their compliance costs.

FAQ

How can I find out if my business needs an accountant

Accounting professionals are hired by many companies when they reach certain levels of financial success. A company may need an accountant if it has more than $10 million in annual sales.

Some companies, however, hire accountants regardless their size. These include small firms, sole proprietorships, partnerships, and corporations.

The size of a company doesn't count. Only important is the use of accounting systems.

If it does, then the accountant is needed. A different scenario is not possible.

What does reconcile account mean?

Reconciliation involves comparing two sets of numbers. One set is called the "source," and the other is called the "reconciled."

Source consists of actual figures. The reconciled is the figure that should have been used.

If you are owed $100 by someone, but receive $50 in return, you can reconcile it by subtracting $50 off $100.

This process ensures that there aren't any errors in the accounting system.

What happens if I don't reconcile my bank statement?

You may not realize you made a mistake until the end of the month if you don't reconcile your bank statements.

This will force you to go over the entire process all over again.

What is the distinction between bookkeeping or accounting?

Accounting is the study of financial transactions. The recording of these transactions is called bookkeeping.

Both are connected, but they are distinct activities.

Accounting deals primarily on numbers, while bookkeeping deals mostly with people.

For reporting purposes on an organization's financial condition, bookkeepers keep financial records.

They ensure that all the books are balanced by correcting entries for accounts payable, accounts receivable or payroll.

Accountants analyze financial statements to determine whether they comply with generally accepted accounting principles (GAAP).

They might recommend changes to GAAP, if not.

Bookskeepers record financial transactions in order to allow accountants to analyze it.

Why is reconciliation so important?

It is vital because mistakes can happen at any time. Mistakes include incorrect entries, missing entries, duplicate entries, etc.

These problems can have serious consequences such as inaccurate financial statements, missed deadlines and overspending.

What is the average time it takes to become an accountant

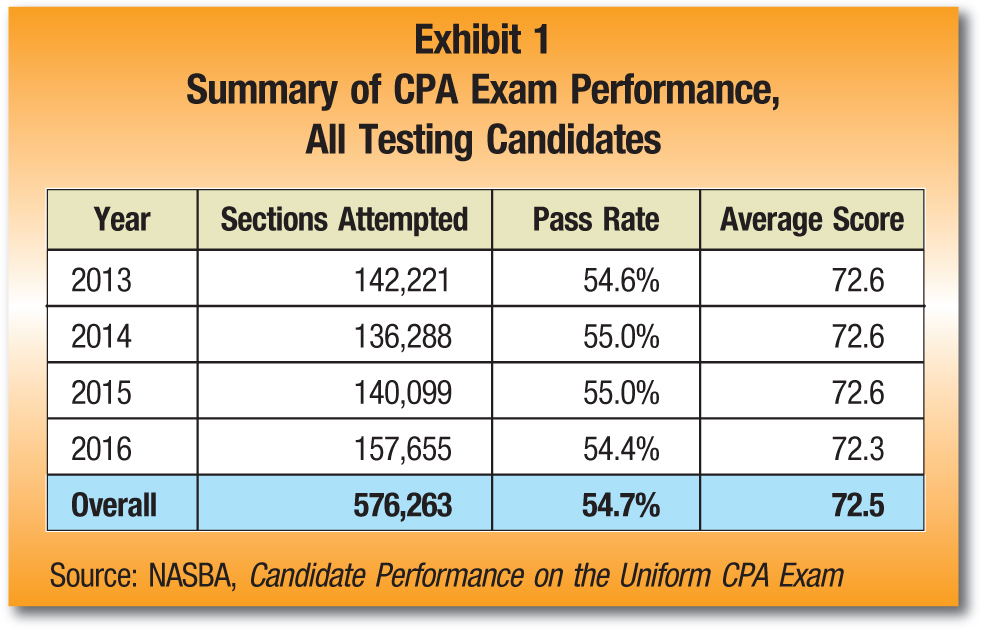

To become an accountant, one needs to pass the CPA exam. Most people who desire to become accountants study approximately four years before they sit down for the exam.

After passing the exam, one must be an associate for at most 3 years in order to become a certified public accounting (CPA) after passing it.

What is a Certified Public Accountant and how do they work?

A C.P.A. certified public accountant is a person who has been certified in public accounting. A person who is certified in public accounting (C.P.A.) has specialized knowledge in the field of accounting. He/she will assist businesses with making sound business decisions and prepare tax returns.

He/She also keeps track of the company's cash flow and makes sure that the company is running smoothly.

Statistics

- The U.S. Bureau of Labor Statistics (BLS) projects an additional 96,000 positions for accountants and auditors between 2020 and 2030, representing job growth of 7%. (onlinemasters.ohio.edu)

- In fact, a TD Bank survey polled over 500 U.S. small business owners discovered that bookkeeping is their most hated, with the next most hated task falling a whopping 24% behind. (kpmgspark.com)

- a little over 40% of accountants have earned a bachelor's degree. (yourfreecareertest.com)

- Employment of accountants and auditors is projected to grow four percent through 2029, according to the BLS—a rate of growth that is about average for all occupations nationwide.1 (rasmussen.edu)

- "Durham Technical Community College reported that the most difficult part of their job was not maintaining financial records, which accounted for 50 percent of their time. (kpmgspark.com)

External Links

How To

How to become an accountant

Accounting is the science that records transactions and analyzes financial data. Accounting can also include the preparation of reports or statements for various purposes.

A Certified Public Accountant is someone who has passed and been licensed by the state board.

An Accredited Finance Analyst (AFA), an individual who meets certain requirements established by the American Association of Individual Investors. A minimum of five years' experience in investment is required by the AAII before an individual can become an AFA. They must pass a series of examinations designed to test their knowledge of accounting principles and securities analysis.

A Chartered Professional Accountant is also known by the name chartered accountant. This is a professional accountant who received a degree at a recognized university. CPAs must adhere to the Institute of Chartered Accountants of England & Wales' (ICAEW), specific educational requirements.

A Certified Management Accountant is a professional accountant who specializes in management accounting. CMAs have to pass exams administered by ICAEW and keep up-to-date with continuing education requirements throughout the course of their careers.

A Certified General Accountant (CGA), member of the American Institute of Certified Public Accountants. CGAs must pass multiple exams. One of these tests, the Uniform Certification Examination or (UCE), is required.

A Certified Information Systems Auditor (CIA) is a certification offered by the International Society of Cost Estimators (ISCES). Candidates for the CIA need to complete three levels in order to be eligible. These include practical training, coursework and a final examination.

An Accredited Corporate Compliance Officer (ACCO) is a designation granted by the ACCO Foundation and the International Organization of Securities Commissions (IOSCO). ACOs need to have a bachelor's degree in finance, public policy, or business administration. They must also pass two written exams as well as one oral exam.

A Certified Fraud Examiner (CFE) is a credential by the National Association of State Boards of Accountancy (NASBA). Candidates must pass 3 exams and score a minimum of 70 percent.

International Federation of Accountants is accredited a Certified Internal Audior (CIA). Four exams must be passed by candidates to receive certification as an Internal Auditor (CIA). They will need to pass topics like auditing, compliance, risk assessment and fraud prevention.

American Academy of Forensic Sciences (AAFS) designates an Associate in Forensic Account (AFE). AFEs should have a bachelor's degree from an accredited college, university or other educational institution in any area of study.

What does an auditor do? Auditors are professionals who inspect financial reporting controls and audit the internal controls. Audits can take place on an individual basis or on the basis of complaints received from regulators.