One of the most difficult aspects of running a business is managing payroll. Payroll accountants are often faced with increasing workloads as a company grows. Not only must the monthly salary be processed on time, compliance with reporting requirements is also important. It can be very time-consuming to maintain a master employee data base. Many businesses decide to outsource their payroll management needs to an external service provider to avoid these problems.

Payroll accounting includes recording debits as well as credits. The debits must be equal to credits in order to be recorded in the books. The originating record is also called gross wages. It records any withholdings or employment taxes. The payroll account must balance before a tax return is prepared. The tax laws affect the amount of payroll. The employee will then receive a tax return reporting the tax payments. After the employee has paid all taxes, accrued wages will be reversed.

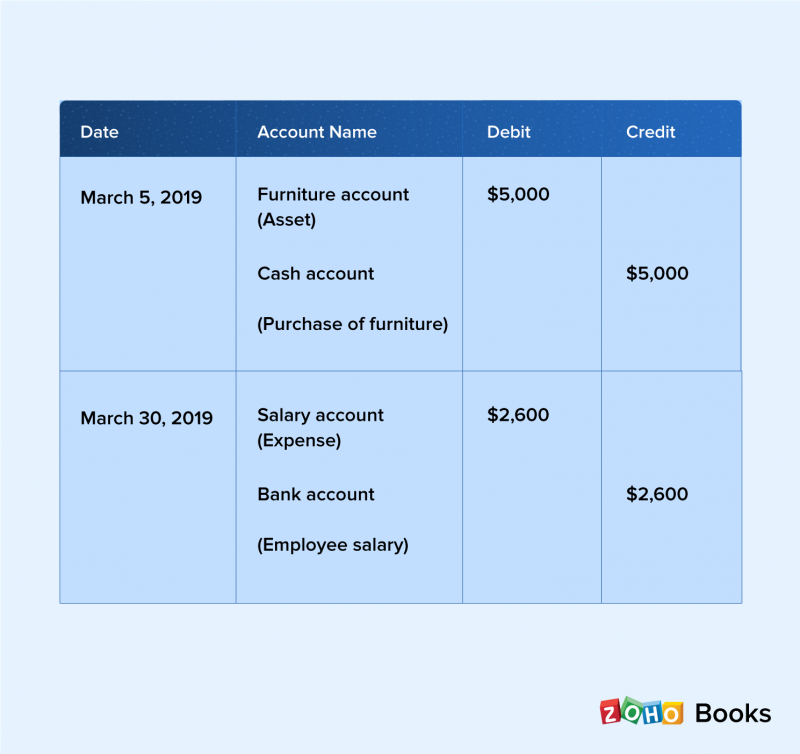

Manual payroll accounting is the third type. This method records company payments to employees. Hourly employees are paid an hourly rate and receive an adjustment based on the number of hours they worked. In addition, companies must record accrued wages and benefits on the last day of the month. This is also called payroll accounting. This involves making journal entries as well as updating payroll line-items. These journal entries are useful for companies to manage their payroll and meet legal requirements.

Payroll accounting is crucial in ensuring proper financial management. It calculates the correct taxes, monitors payroll expenses, and reports these figures to Internal Revenue Service. The payroll accounting process saves an organization time and ensures the accuracy of the data that is being processed. This task is often entrusted to accountants or bookkeepers by business owners. Larger firms have their own departments for accounting. This allows the accounting staff to concentrate on other business aspects, such sales and marketing.

Payroll accounting is vital for maintaining compliance with all laws and regulations. This includes calculating wages, taxes, benefits, and other expenses for employees. Payroll accounting documents include timesheets. Work time-cards. Employment contracts. Accounting documents also include the amounts a company owes to its employees. This document is called the payroll. The sum of all these entries is called the payroll.

Every business must have payroll. It tracks the hours worked and the compensation earned by employees. Most businesses consider payroll a major expense. Payroll is almost always deductible which reduces the business's tax liability. Due to overtime and sick pay, payroll can change from one pay period to another. Payroll management includes many different processes, from recording employee hours to calculating pay to distributing payments via direct deposit or other method.

This skill set requires that an accountant be familiar with tax laws. The payroll department must withhold the appropriate taxes from each employee's paychecks. These taxes include federal and state income tax, Social Security, unemployment, and Social Security taxes. This knowledge is necessary to calculate net wages and gross wages accurately. To ensure compliance, payroll accountants need to calculate the appropriate withholdings on each paycheck.

FAQ

How much do accountants make?

Yes, accountants get paid hourly.

Complicated financial statements can be a charge for some accountants.

Sometimes accountants will be hired to complete specific tasks. For example, a public relations firm might hire an accountant to prepare a report showing how well their client is doing.

What does an auditor do?

Auditors look for inconsistencies among the financial statements' information and the actual events.

He ensures that the figures provided are accurate.

He also checks the validity of financial statements.

What is bookkeeping?

Bookkeeping refers to the process of keeping financial records for individuals, companies, or organizations. This includes all income and expenses related to business.

Bookkeepers track all financial information such as receipts, invoices, bills, payments, deposits, interest earned on investments, etc. They also prepare tax returns and other reports.

Statistics

- Given that over 40% of people in this career field have earned a bachelor's degree, we're listing a bachelor's degree in accounting as step one so you can be competitive in the job market. (yourfreecareertest.com)

- a little over 40% of accountants have earned a bachelor's degree. (yourfreecareertest.com)

- The U.S. Bureau of Labor Statistics (BLS) projects an additional 96,000 positions for accountants and auditors between 2020 and 2030, representing job growth of 7%. (onlinemasters.ohio.edu)

- Employment of accountants and auditors is projected to grow four percent through 2029, according to the BLS—a rate of growth that is about average for all occupations nationwide.1 (rasmussen.edu)

- According to the BLS, accounting and auditing professionals reported a 2020 median annual salary of $73,560, which is nearly double that of the national average earnings for all workers.1 (rasmussen.edu)

External Links

How To

The Best Way To Do Accounting

Accounting is a system of processes that allows businesses to accurately record transactions and keep track of them. Accounting involves recording income and expense, keeping track sales revenue and expenditures and preparing financial statements.

It involves reporting financial results on behalf of stakeholders, such as shareholders and lenders, investors, customers, or other parties.

Accounting can be done in many different ways. There are several ways to do accounting.

-

You can also create spreadsheets manually.

-

Using software like Excel.

-

Notes on paper for handwriting

-

Use computerized accounting systems.

-

Online accounting services.

Accounting can be done in several ways. Each method has both advantages and disadvantages. Which one you choose will depend on your business model, needs and preferences. Before you decide on any one method, consider all the pros and disadvantages.

In addition to being efficient, there are other reasons you may decide to use accounting methods. Self-employed people might prefer to keep detailed books, as they are evidence of the work you have done. You might prefer simple accounting methods if your business is small or does not have large financial resources. On the other hand, if your business generates large amounts of cash, you might want to use complex accounting methods.