Before we get into the benefits of hiring bookkeepers, let's first discuss what bookkeeping is. Noah Webster created the Webster dictionary in the early nineteenth century. Its 1913 edition is one of the most complete. Bookkeepers create financial statements and reports for businesses that allow them to track cash flow and make decision. Bookkeepers are also available to be hired at any time. You can find them online.

Objects of Bookkeeping

Bookkeeping is the recording of all transactions in a book. This practice has three main goals: to present a clear picture on the financial status of the business, to provide statistical information and to prove the accuracy. To determine the exact transaction nature, bookskeeping records can be grouped and categorized. This allows one to quickly assess the business's financial standing.

The opening entry is the entry that appears in the bookkeeping journal. The opening entry records that the business is open. The closing entry will also be recorded in the journal. These adjustments will be closely reviewed by the accounting bookkeeper. He should know the purpose of each entry as well as how they relate to the financial standing and business. The bookkeeper might not understand the purpose of bookkeeping and make an error in entering.

Bookskeepers prepare reports

The bookkeeper is usually responsible for three types of financial statements: the balance, the profit & loss statement, or the cash flow statement. The latter two are essential to analyzing the overall health of the business and setting financial strategies for the year ahead. Bookkeepers typically use accounting software to prepare the necessary financial statements and then share them with the company's accountant or tax preparer. This ensures that data is accurate.

Before accounting software, bookkeepers had no choice but to manually record and calculate each account’s balances and then prepare a test balance. This included calculating the totals in the credit and debit columns, ensuring the sum was equal to the amount in the account's debit column. It took hours to find inaccuracies in the accounts, making these reports essential for strategic business decisions. But the bookkeeper's role has changed drastically.

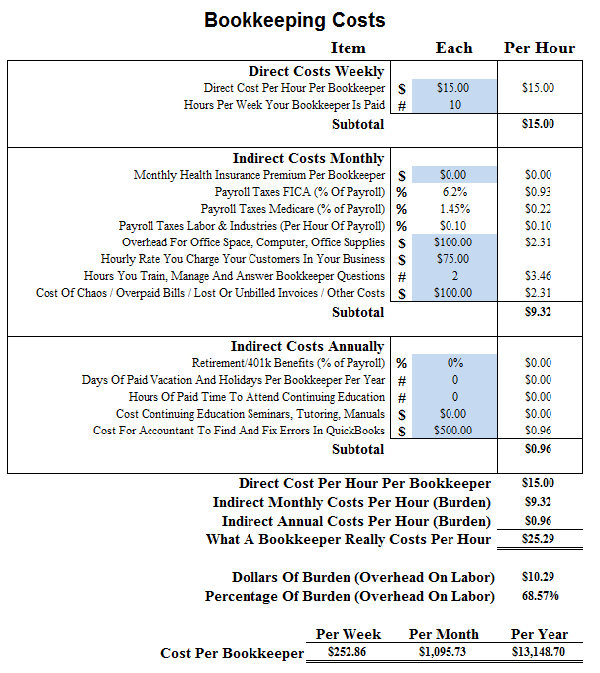

Bookkeeper hiring costs

The annual earnings of a bookkeeper working full-time can range from $35,000 to $55,000. Your overhead and benefits will be 20 percent. Maintaining your books in order to maintain financial strength is crucial for any business. Some bookkeepers also work as controllers or financial analysts. Their rates can be as high as $200 an hour, depending on the level of experience. Continue reading to find out more about the cost of hiring a bookkeeper.

A bookkeeper may not be the best choice for you. This task can be very time-consuming and detailed. Bookkeepers can get burned out and take away time from your business. If you have the funds and need an extra hand, hiring a professional bookkeeper could be a good choice. Costs to hire a bookkeeper are dependent on your business's size, complexity, and the number and type of tasks they'll be required to do.

FAQ

What is the importance of bookkeeping and accounting?

Bookskeeping and accounting are vital for any business. They can help you keep track if all your transactions are recorded and what expenses were incurred.

They can also help you avoid spending too much on unnecessary things.

Know how much profit you have made on each sale. You'll also need to know what you owe people.

If you don’t have enough money, you might think about raising the prices. Customers might be turned off if prices are raised too high.

If you have more inventory than you can use, it may be worth selling some.

If you have less than you need, you could cut back on certain services or products.

All of these factors will impact your bottom line.

Accounting Is Useful for Small Business Owners

Accounting isn’t only for big businesses. Accounting is also beneficial for small business owners, as it allows them to keep track of all their money.

If you own a small business, then you probably already know how much money you have coming in each month. But what happens if you don’t have a professional accountant to help you with this? You might find yourself wondering where you are spending your money. You could also forget to pay bills on-time, which could impact your credit score.

Accounting software makes managing your finances simple. There are many kinds of accounting software. Some are completely free, while others can cost hundreds of thousands of dollars.

You will need to learn the basic functions of every accounting system. You won't have to spend time learning how it works.

These three tasks are essential.

-

Enter transactions into the accounting system.

-

Keep track of your income and expenses.

-

Prepare reports.

After you have mastered these three points, you can start to use your new accounting software.

What's the purpose of accounting?

Accounting gives an overview of financial performance. It measures, records, analyzes, analyses, and reports transactions between parties. Accounting allows organizations make informed decisions about how much money to invest, how likely they are to earn from their operations, and whether or not they need to raise additional capital.

Accounting professionals record transactions to provide financial information.

The organization can use the collected data to plan its future strategy and budget.

It is essential that data be accurate and reliable.

What does reconcile account mean?

The process of reconciliation involves comparing two sets. The source set is called the “source,” while the reconciled set is called both.

The source consists of actual figures, while the reconciled represents the figure that should be used.

For example, suppose someone owes $50 but you only get $50. You would subtract $50 from $100 to reconcile the situation.

This ensures there are no errors in the accounting system.

What should I do when hiring an accountant?

When hiring an accountant, ask questions about their experience, qualifications, and references.

You want someone who has done this before and knows what he/she is doing.

Ask them about any skills or knowledge they may have that could be of assistance to you.

Look for people who are trustworthy in your community.

What is a Certified Public Accountant (CPA)?

A C.P.A. certified public accountant is a person who has been certified in public accounting. An accountant is someone who has special knowledge in accounting. He/she will assist businesses with making sound business decisions and prepare tax returns.

He/She monitors cash flow for the company and makes sure the company runs smoothly.

What is the difference between bookkeeping and accounting?

Accounting studies financial transactions. These transactions are recorded in bookkeeping.

Both are connected, but they are distinct activities.

Accounting deals primarily using numbers, while bookskeeping deals primarily dealing with people.

For reporting purposes on an organization's financial condition, bookkeepers keep financial records.

They ensure all books balance by correcting entries in accounts payable and accounts receivable.

Accountants examine financial statements in order to determine whether they conform with generally accepted accounting practices (GAAP).

They might recommend changes to GAAP, if not.

For accountants to be able to analyze the data, bookkeepers must keep track of financial transactions.

Statistics

- Employment of accountants and auditors is projected to grow four percent through 2029, according to the BLS—a rate of growth that is about average for all occupations nationwide.1 (rasmussen.edu)

- The U.S. Bureau of Labor Statistics (BLS) projects an additional 96,000 positions for accountants and auditors between 2020 and 2030, representing job growth of 7%. (onlinemasters.ohio.edu)

- a little over 40% of accountants have earned a bachelor's degree. (yourfreecareertest.com)

- In fact, a TD Bank survey polled over 500 U.S. small business owners discovered that bookkeeping is their most hated, with the next most hated task falling a whopping 24% behind. (kpmgspark.com)

- a little over 40% of accountants have earned a bachelor's degree. (yourfreecareertest.com)

External Links

How To

How to get a degree in accounting

Accounting is the process of keeping track of financial transactions. It records transactions made by individuals, governments, and businesses. Bookkeeping records are also included under the term "account". Accounting professionals create reports based upon these data in order to assist companies and organizations with making decisions.

There are two types if accountancy: general (or corporate), and managerial. General accounting involves the reporting and measurement business performance. Management accounting focuses on measuring, analyzing, and managing the resources of organizations.

A bachelor's degree in accounting prepares students to work as entry-level accountants. Graduates can also opt to specialize in areas such as auditing, taxation or finance management.

Accounting is a career that requires a solid understanding of economic concepts like supply and demand and cost-benefit analysis. Marginal utility theory, consumer behavior, price elasticity of demand and law of one price are all important. They should also be able to understand macroeconomics, microeconomics and accounting principles as well as various accounting software packages.

A Master's degree in Accounting requires that students have successfully completed six semesters worth of college courses. These include Microeconomic Theory, Macroeconomic Theory. International Trade. Business Economics. Financial Management. Auditing Principles & Procedures. Accounting Information Systems. Cost Analysis. Taxation. Human Resource Management. Finance & Banking. Statistics. Mathematics. Computer Applications. English Language Skills. Graduate Level Examination is also required. This examination is normally taken after students have completed three years of education.

Four years of undergraduate education and four years postgraduate study are required to become certified public accountants. Before they can apply for registration, candidates will need to take additional exams.