Before you hire an accountant, it is worth considering the price of their services. A full-time or part time professional can be chosen that has the appropriate experience and expertise in your field. They can also negotiate prices if needed. Avoid unnecessary expenses by researching several accountants. After choosing the right person, it's time to obtain an engagement letter that outlines what you expect of the accountant. Take the time to gather your financial information, and meet with them to find the best match for you.

The cost of hiring an accountant

An accountant is essential if you are starting a new company or expanding an existing business. A professional accountant can review and present critical financial data, prepare budgets, reports, and file tax returns. A professional can help you improve your business by keeping accurate records and making recommendations. The benefits of an accountant are well worth the expense. After you have established a new business, or increased your income significantly, you should continue to work with an accountant.

It is important to consider the service that you require before you hire an accountant. If the work is limited and includes balancing accounts and preparation of financial statements, an accountant for small businesses can charge less. But if your business needs complex financial services and you are looking to hire a full-time professional accountant, then you might have to pay more. You can save money by hiring an accountant if you handle the basic tasks yourself using accounting software or your existing staff.

Finding a CPA

CPAs are required to help you hire an accountant. You should be careful when looking for a CPA. Avoid unprofessional CPAs, who may promise a large refund of taxes before they have even looked at your records. It is not a good idea to choose a CPA solely for their price. Also, you should find out how easy it is for the person to communicate with you. Even though you don't need to be besties, it is important you feel comfortable asking questions as well as seeking out assistance.

When interviewing potential CPAs for your firm, ensure that they have relevant experience in your field. CPAs with more experience than two years in accounting are likely to be better equipped for complex problems than those who have only been in practice for one year. This is particularly important if you require ongoing accounting services or tax season assistance. Your CPA should also have experience representing you in front of the IRS.

Finding a full-time or part-time CPA

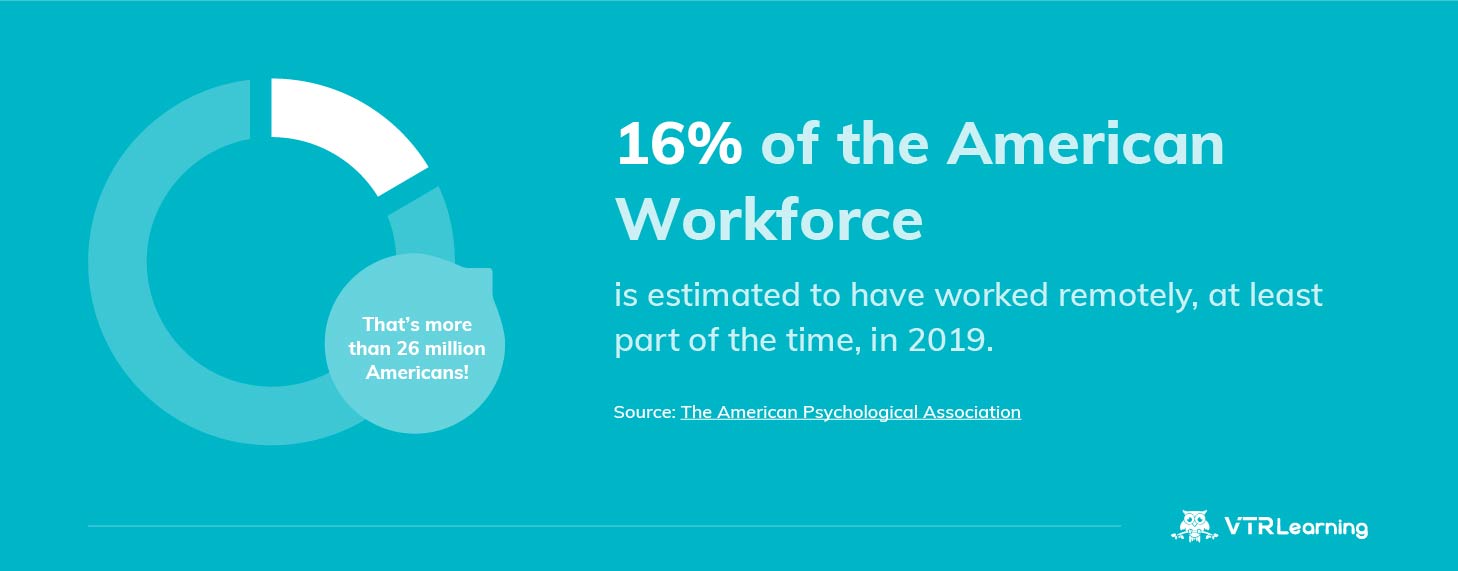

CPAs are in high demand and organizations should look into the benefits of part-time or full time positions. These professionals enjoy flexibility and can work from home. Part-time CPAs can earn less than full-time CPAs but they have the same experience, skills set, and personality that make them great candidates for public accounting. Organizations that offer this flexibility can increase their talent pool, which in turn will reduce turnover.

Whether you prefer full-time or part-time study, your degree will prepare you for the CPA exam. You should consider enrolling in an accredited accounting degree program. You can often complete the program in one or two semesters depending on your schedule and availability. CPAs who work full-time should avoid taking more than two courses per quarter. If you are working full time, it is best to avoid taking more than two accounting courses per semester.

A CPA with the right experience is key to your success

It is crucial to have the right experience when hiring an accountant. A certified public accountant may be helpful, but it is also advantageous to hire an experienced one. These four tips will assist you in choosing the right CPA. Here are some steps to take when you need an accountant.

Ask for referrals and inquire about their experiences. Do not trust anyone who says they work with all types and clients. You don’t want to work with someone who only does taxes in tax season. It is also important to ask about their methods of calculating their rates. They may not be the best fit for you. Also, consider whether your accountant prefers you to work remotely or at his or her office.

Before you hire a CPA to help you, verify that the CPA has been registered in the state where he or she lives. To get an idea of how people feel about their services, you can look at online reviews. However, you can't learn everything about an accountant from online reviews. The best accountant for you is the one that suits your needs and communicates well. If the CPA you are considering isn't meeting your needs, you can always pick another one.

FAQ

What training do you need to become a bookkeeper

Basic math skills are required for bookkeepers. These include addition, subtraction and multiplication, divisions, fractions, percentages and simple algebra.

They must also be able to use a computer.

Many bookkeepers have a highschool diploma. Some have even earned college degrees.

What should I expect from an accountant when I hire them?

Ask questions about experience, qualifications and references before hiring an accountant.

You want someone who's done this before and who knows the ropes.

Ask them if they have any knowledge or skills that might be useful to you.

Look for people who are trustworthy in your community.

What is the significance of bookkeeping and accounting

Bookkeeping and accounting is essential for any business. They help you keep track of all your transactions and expenses.

They can also help you avoid spending too much on unnecessary things.

Know how much profit you have made on each sale. You'll also need to know what you owe people.

If you don't have enough money coming in, then you might want to try raising prices. Customers might be turned off if prices are raised too high.

You may be able to sell some inventory if you have more than what you need.

If you have less than you need, you could cut back on certain services or products.

These things can have a negative impact on your bottom line.

What does an auditor do exactly?

An auditor looks for inconsistencies between the information given in the financial statements and the actual events.

He verifies the accuracy of all figures supplied by the company.

He also validates the validity and reliability of the company's financial statements.

How can I get started keeping books?

For you to begin keeping your books, you'll need a few things. You will need a notebook, pencils and calculators, a printer, stapler, pen, stapler, envelopes and stamps, as well as a filing cabinet or drawer.

Statistics

- a little over 40% of accountants have earned a bachelor's degree. (yourfreecareertest.com)

- Given that over 40% of people in this career field have earned a bachelor's degree, we're listing a bachelor's degree in accounting as step one so you can be competitive in the job market. (yourfreecareertest.com)

- "Durham Technical Community College reported that the most difficult part of their job was not maintaining financial records, which accounted for 50 percent of their time. (kpmgspark.com)

- a little over 40% of accountants have earned a bachelor's degree. (yourfreecareertest.com)

- In fact, a TD Bank survey polled over 500 U.S. small business owners discovered that bookkeeping is their most hated, with the next most hated task falling a whopping 24% behind. (kpmgspark.com)

External Links

How To

How to Get a Degree in Accounting

Accounting is the practice of keeping track financial transactions. Accounting includes the recording of transactions by individuals, businesses, and governments. Bookkeeping records are also included under the term "account". These data are used by accountants to create reports that help companies or organizations make decisions.

There are two types of accountancy - general (or corporate) accounting and managerial accounting. General accounting focuses on the reporting and measurement of business performance. Management accounting focuses primarily on the measurement, analysis, and management of resources.

A bachelor's degree in accounting prepares students to work as entry-level accountants. Graduates can also opt to specialize in areas such as auditing, taxation or finance management.

For students interested in pursuing a career of accounting, they should be able to understand basic economic concepts such as supply/demand, cost-benefit analysis (MBT), marginal utility theory, consumer behavior and price elasticity of demand. They need to know about accounting principles, international trade, microeconomics, macroeconomics and the various accounting software programs.

For students to pursue a Master's in Accounting, they must have completed at minimum six semesters of college courses including Microeconomic Theory; Macroeconomic Theory and International Trade; Business Economics. Graduate Level Examinations must also be passed. This exam is typically taken at the end of three years' worth of study.

Candidats must complete four years' worth of undergraduate study and four years' worth of postgraduate work in order to be certified public accountants. The candidates must pass additional exams before being eligible to apply for registration.